Alpha is a term used in stock market investment to describe the excess return of an investment relative to the return of a benchmark index. It is a measure of the investment’s performance compared to the market as a whole, taking into account the risk taken to achieve that return. In this article, we will learn what is alpha in the stock market in more detail, how it is calculated, its significance for investors, and how it can be used to evaluate investment performance. We will also discuss some strategies for generating alpha and the factors that can impact an investment’s alpha.

What Is Alpha?

Alpha is a fundamental concept in finance that measures the performance of an investment against a benchmark index or a risk-free rate. It is used to assess the skill of an investment manager or the effectiveness of an investment strategy in generating returns.

Alpha is calculated as the difference between the actual return on an investment and the return that would be expected given the risk of the investment. In other words, it measures the excess return of the investment over what would be predicted by its beta, a measure of its volatility or systematic risk.

For example, if a mutual fund has an alpha of 1.0, it indicates that the fund has outperformed its benchmark index by 1% after adjusting for risk. Similarly, a negative alpha indicates underperformance compared to the benchmark.

Alpha is important because it helps investors determine whether a fund manager is adding value through active management. A positive alpha suggests that the manager is generating returns above what would be expected given the level of risk, indicating skill in stock selection or market timing. Conversely, a negative alpha may suggest that the fund manager is not adding value and may be better off investing in a passive index fund.

It’s important to note that alpha is just one measure of performance and should be considered along with other factors such as beta, standard deviation, and Sharpe ratio when evaluating an investment or a fund manager.

How Is Alpha Calculated?

Alpha is calculated by comparing the actual returns of an investment to the expected returns based on its risk level, typically measured by its beta.

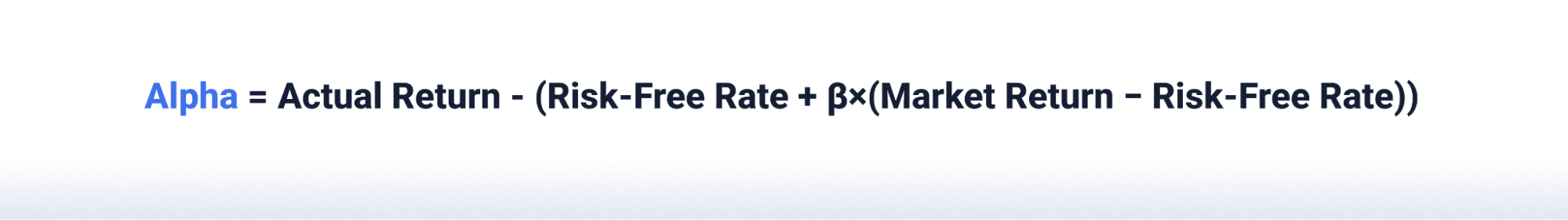

The formula for alpha is:

Where:

- Actual Return is the return earned by the investment.

- Risk-Free Rate is the return on a risk-free investment, such as a Treasury bond.

- Beta (β) measures the volatility of the investment relative to the market.

- Market Return is the return of the overall market index.

A positive alpha indicates that the investment has outperformed its expected return based on its risk level, while a negative alpha indicates underperformance.

Understanding Performance Metrics in Investing

In the world of investing, alpha serves as a key metric for evaluating the performance of various investment options. It represents the excess return of an investment compared to a benchmark index, indicating how well an investment has performed relative to the market.

For example, if an investment has an alpha of +2.0, it means that it has outperformed the benchmark index by 2 percentage points. Conversely, an alpha of -5.0 would indicate underperformance relative to the benchmark by 5 percentage points.

A more nuanced analysis of alpha often includes Jensen’s alpha, which incorporates the capital asset pricing model (CAPM) to adjust for risk. CAPM uses beta, a measure of an asset’s volatility compared to the market, to calculate the expected return of an asset. Jensen’s alpha considers this risk-adjusted return, providing a more comprehensive view of performance.

It’s important to note that different market conditions and investment cycles can impact the alpha of investments across various asset classes. This underscores the significance of considering risk-return metrics alongside alpha when evaluating investment options.

Overall, understanding alpha and its nuances can help investors make informed decisions, guiding them toward investments that align with their financial goals and risk tolerance levels.

Importance of Alpha in Stock Market Investing

- Performance Measurement: Alpha helps investors and fund managers assess the effectiveness of their investment strategies. A positive alpha indicates that the investment has outperformed the market, while a negative alpha suggests underperformance.

- Risk-Adjusted Returns: Alpha provides a measure of risk-adjusted returns, taking into account the volatility or riskiness of an investment. It helps investors evaluate whether the excess return justifies the level of risk taken.

- Differentiation: Alpha helps differentiate between skilled and unskilled managers. Skilled managers are expected to generate positive alpha, indicating their ability to outperform the market after adjusting for risk.

- Benchmarking: Alpha allows investors to compare the performance of different investments or portfolios against a benchmark index. It provides a standardized measure for evaluating performance.

- Investment Decision Making: Alpha can influence investment decisions by indicating whether an investment is meeting expectations or if adjustments need to be made to the investment strategy.

- Fee Justification: For investors in actively managed funds, alpha helps justify the fees charged by fund managers. Positive alpha can indicate that the manager’s expertise adds value beyond passive investing.

Overall, alpha is a valuable metric for assessing investment performance, understanding risk-adjusted returns, and making informed investment decisions.

Limitations of Alpha

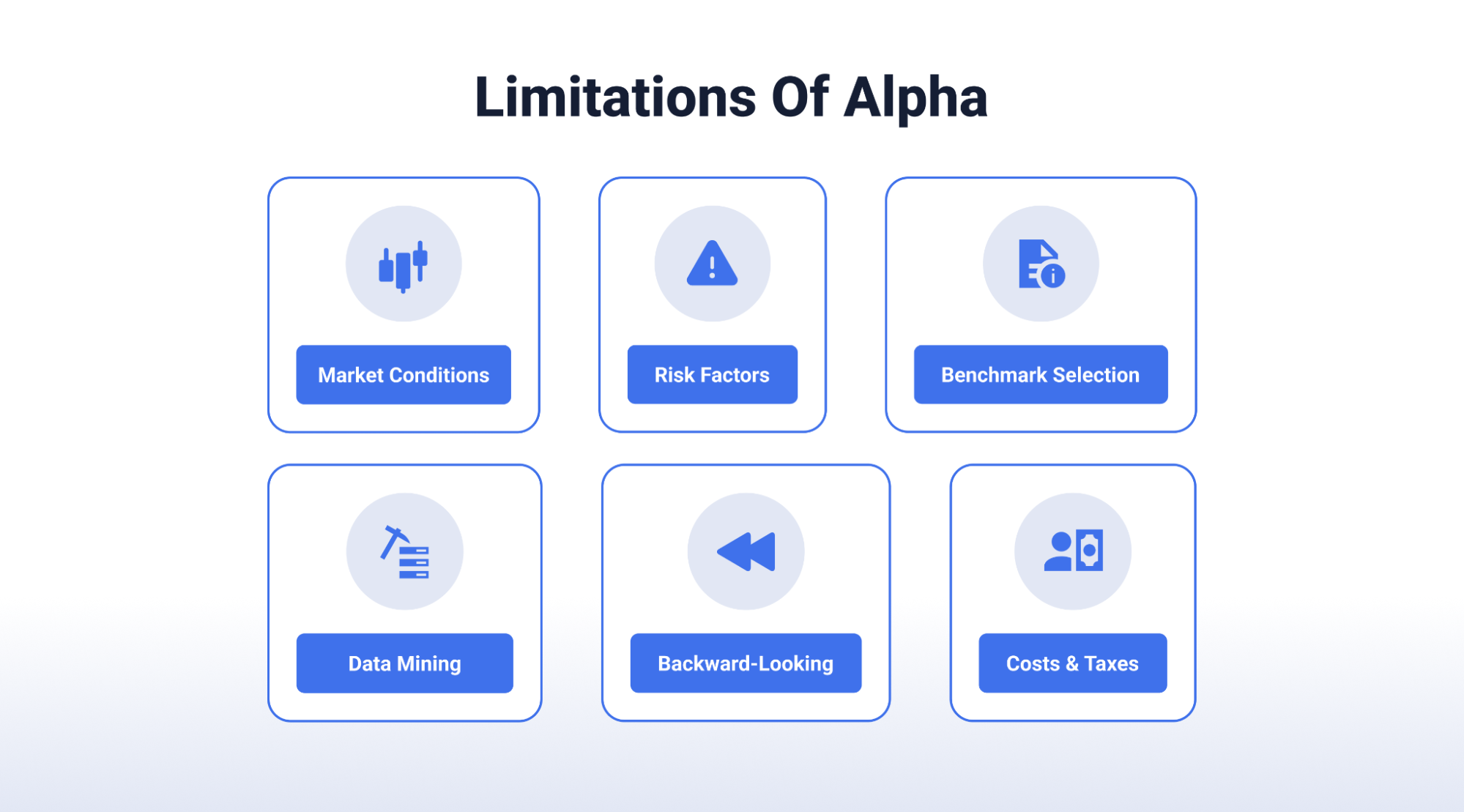

While alpha is a useful metric for evaluating investment performance, it has several limitations that investors should be aware of:

- Market Conditions: Alpha is calculated based on historical data and may not accurately predict future performance, especially during changing market conditions or in volatile markets.

- Risk Factors: Alpha does not account for all risk factors that may affect an investment, such as geopolitical events, regulatory changes, or macroeconomic trends. It primarily focuses on the relationship between an investment’s returns and its benchmark.

- Benchmark Selection: The choice of benchmark can significantly impact the calculation of alpha. Different benchmarks may result in different alpha values, making it challenging to compare investments across different benchmarks.

- Data Mining: In some cases, alpha can be a result of data mining or luck rather than skill. Random fluctuations in returns or statistical anomalies may lead to misleading alpha values.

- Backward-Looking: Alpha is based on historical data and may not reflect current market conditions or future performance. It is important to consider other factors and conduct thorough analysis when making investment decisions.

- Costs and Taxes: Alpha does not account for transaction costs, taxes, or other fees associated with investing. These costs can significantly impact the net return on investment and should be considered when evaluating alpha.

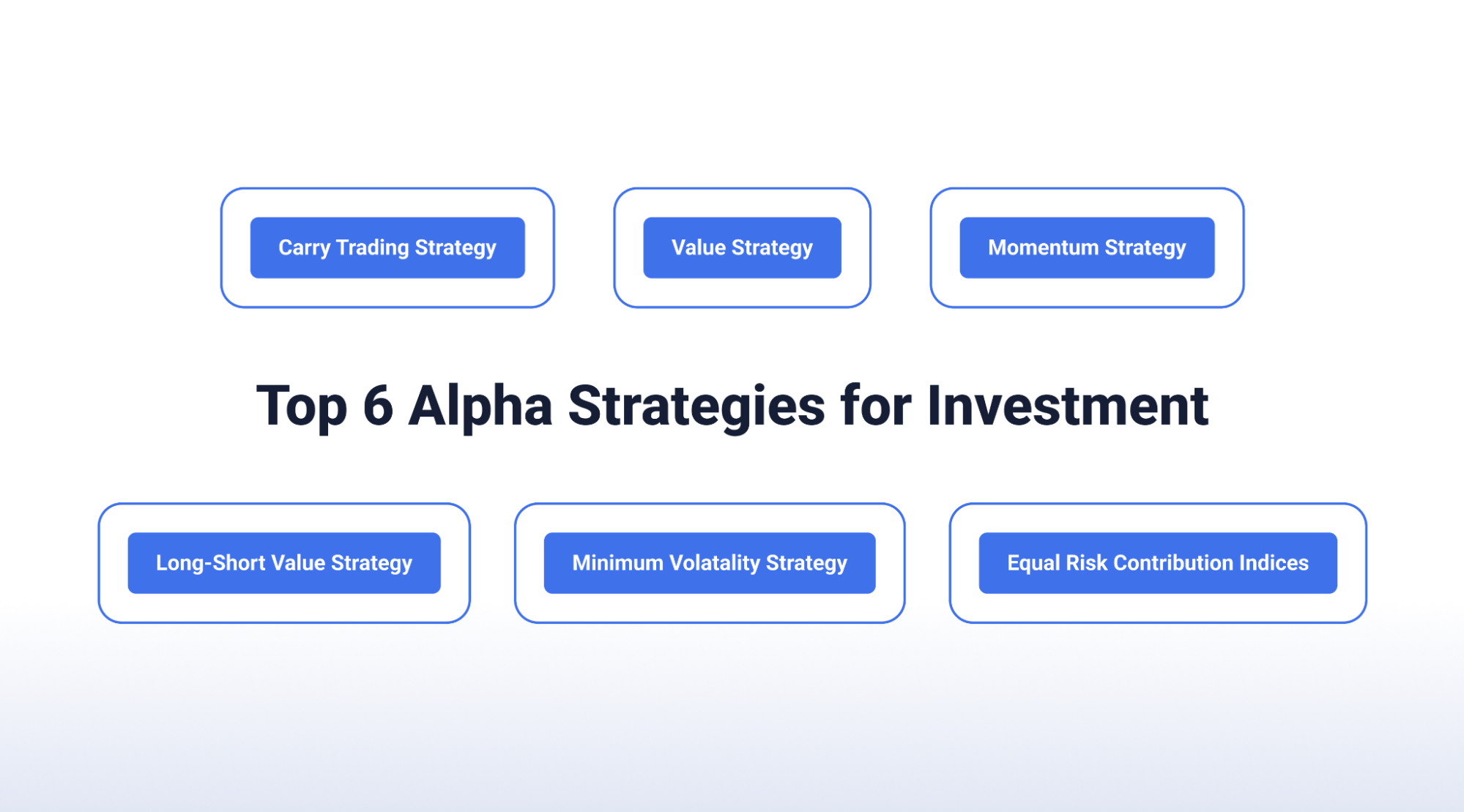

Top 6 Alpha Strategies For Investment

Carry Trading Strategy

Carry trading involves borrowing in a currency with a low-interest rate and investing in another currency with a higher interest rate. The goal is to profit from the interest rate differential between the 2 currencies. For example, An investor in India might borrow in Indian rupees (INR) and invest in Australian dollars (AUD), which historically has had higher interest rates compared to INR. If the Australian dollar appreciates against the Indian rupee, the investor can make a profit when they convert their Australian dollars back into Indian rupees.

Value Strategy

Value investing is based on the principle of buying stocks that are undervalued relative to their intrinsic value. Investors using this strategy look for stocks that are trading at a discount compared to their fundamental value, such as stocks with low price-to-earnings (P/E) ratios or low price-to-book (P/B) ratios. The idea is that over time, the market will recognize the true value of these stocks, leading to price appreciation and potentially higher returns for investors.

Momentum Strategy

Momentum investing involves buying stocks that have shown positive price momentum in the past and selling stocks that have shown negative momentum. The belief behind this strategy is that stocks that have been performing well in the past will continue to perform well in the future, and vice versa. Momentum investors typically use technical analysis and trend-following indicators to identify stocks with strong momentum.

Long-Short Value Strategy

This strategy combines elements of both long and short strategies. Investors using this approach will buy undervalued stocks (long positions) while simultaneously selling overvalued stocks (short positions). By taking both long and short positions, investors can potentially profit from both rising and falling stock prices. This strategy is often used to hedge against market risk, as the short positions can help offset losses from the long positions during market downturns.

Minimum Volatility Strategy

Minimum volatility strategies aim to construct a portfolio with the lowest possible level of volatility. This is achieved by selecting stocks with historically low volatility and low correlations with each other. By reducing volatility, these strategies seek to provide more stable returns, which can be particularly attractive to conservative investors or those nearing retirement.

Equal-Risk-Contribution Indices

These indices are constructed to ensure that each stock in the index contributes equally to the overall risk of the portfolio. This is achieved by weighting stocks based on their volatility and correlation with other stocks in the index. By equalizing risk contributions, these indices aim to provide more balanced returns and reduce the impact of individual stock movements on the overall portfolio.

Alpha strategies, when used in combination, offer a comprehensive approach to investment management. By incorporating these strategies into a diversified portfolio, investors can potentially enhance returns and manage risk more effectively across various market conditions.

Conclusion

Understanding alpha is crucial for investors seeking to outperform the market. Strategies such as carry trading, value investing, momentum trading, and risk management techniques like minimum volatility and equal-risk-contribution indices can all contribute to generating alpha and managing investment risks.

While alpha strategies can complement each other and enhance portfolio performance, investors should carefully consider their risk tolerance and investment goals when implementing these strategies. Overall, alpha offers a valuable tool for investors to optimize their investment strategies and achieve their financial objectives.

If you are looking for a comprehensive set of stock trading solutions in one place, consider TradeSmart. We provide real-time support during market hours, backed by over 2 decades of stock market experience. Open a free demat account with us and enjoy low brokerage fees of INR 15 per executed order, irrespective of the trade size or segment.

Disclaimer: This article is for information purposes only and should not be considered as stock recommendation or advice to buy or sell shares of any company. Investing in the stock market can be risky. It is therefore advisable to research well or consult an investment advisor before investing in shares, derivatives, or any other such financial instruments traded on the exchanges.

FAQs

Q. What is alpha in stock market investment?

Alpha is a measure of an investment’s performance relative to a benchmark index, indicating the excess return generated by the investment manager.

Q. How is alpha calculated?

Alpha is calculated by subtracting the expected return of the investment based on its beta (a measure of its volatility relative to the market) from its actual return.

Q. What does positive and negative alpha indicate?

A positive alpha indicates that the investment has outperformed its benchmark, while a negative alpha indicates underperformance.

Q. What factors can influence alpha?

Factors such as market conditions, economic trends, company performance, and the skill of the investment manager can all influence alpha.

Q. Can alpha be used as a standalone measure of investment performance?

No, alpha should be considered alongside other measures such as beta, standard deviation, and Sharpe ratio to get a comprehensive view of investment performance.

Q. How can investors use alpha in their investment decisions?

Investors can use alpha to identify investment opportunities that have the potential to outperform the market and to assess the skill of investment managers.

Q. Are there any limitations to using alpha as a measure of investment performance?

Yes, alpha does not account for the level of risk taken to achieve the returns, and it may not be a reliable indicator of future performance.

Q. Can alpha be negative?

Yes, a negative alpha indicates that the investment has underperformed its benchmark, suggesting that the investment manager has not added value relative to the market.

Q. Is alpha the only measure of investment performance?

No, alpha should be considered alongside other performance metrics such as beta, standard deviation, and Sharpe ratio to get a complete picture of investment performance.

Q. How can investors mitigate the risks associated with alpha investing?

Diversification, careful selection of investment strategies, and regular monitoring of investment performance can help mitigate the risks associated with alpha investing.

[…] Also Read : Alpha, the God of Active Investments! […]