As they say, A picture says a thousand words, this perfectly stands true in the terms of technical analysis, where the whole share trading statistics is plotted on a pictorial representation.

A technical chart is the graphical representation of open, high, low and close of a stock on a X and Y axis based stock chart.

X Axis represents the DURATION in minutes/ Days/ weeks/ months etc

Would decoding a technical chart help stock traders understanding trading better?

Y Axis represents the PRICE of the underlying

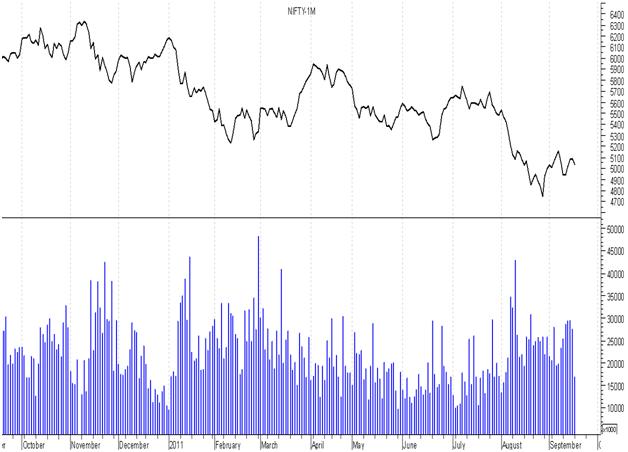

As you can see in the chart the whole data of closing prices of a stock is now plotted in a graphical presentation which gives a more clear picture of the trend, as compared to viewing the same data in a tabular format. Online trading apps and platforms has made it easy to plot and analyse the charts

The charts make it easy and technically possible to do all kinds of stock market analysis and future market predictions based on the past data.

Also Read : Options Strategy: Straddle and Strangle

In the chart above (taken from online share trading platform) one can also see a lower column of Volume, which states the total number of shares traded on that particular day. Volumes help a technical analyst confirm a trend as if a stock has risen with good volumes the rally will stay for a longer time.

Chart time periods

Technical Charts can be drawn with a specific view and timeline by online share trading platform to take a more micro or macro trend analysis of stock, the chart time periods can be following :-

- Daily EOD: Chart where one Candle/ Bar/ Dot represents the trading of a single trading day, These charts are also known as Daily chart.

- Intraday: A continuous tick chart which represents the trading of that day Tick by tick, This chart is used by Intraday and short term traders.

- Weekly: Chart which represents the weekly trading and one bar represent the stock trading of a week.

- Monthly: Charts which represent the stock trading of months, one month is represented by one bar.

- Quarterly: Chart which represents the stock trading of a one quarter( 3 months)

- Yearly: Charts are very rarely used. It represents the year wise stock trading patterns, where one Bar represents one year or trading.

Also Read : Top 5 Technical Analysts of India and their Trading Secrets

So a stock market trader can use both EOD and Weekly data to see whether a trend confirmation has occurred on both the charts or it is still premature to confirm a trend on a stock, so as an analyst it is always important to keep a watch on all the time periods to get a more holistic view on a chart.

Join Us Now To Learn

Decoding A Technical Chart

[email-subscribers namefield=”NO” desc=”Subscribe now to get latest updates!” group=”Public”]

[…] Also Read : Decoding a Technical Chart […]

[…] Also Read : Decoding a Technical Chart […]

[…] Also Read : Decoding a Technical Chart […]

Hi Shalin,

We use MetaStock for charting/diagrams.

Hi, what is the chart / diagramming software you used to create these diagrams / charts?

Is it creately ?