Gold is one of the most precious and valuable commodity. With time, this commodity turned into an important assets class, and the possession of the gold changed from gold jewelry to paper gold, but the value of the metal remained the same.

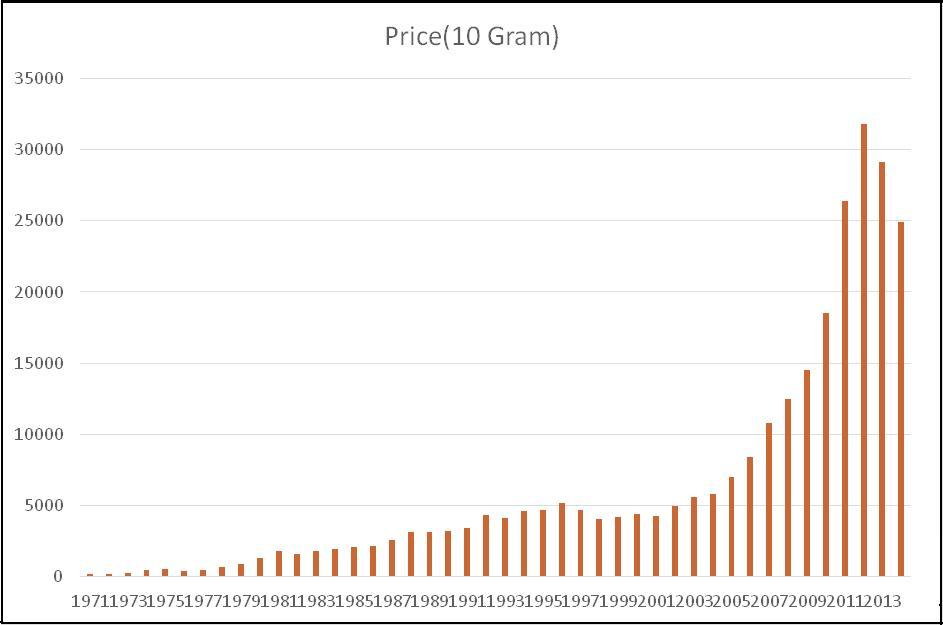

Price Chart of Gold of Last 10 Year

Ways to invest in gold for stock broker

Gold is seen as a safe-haven investment option, not only is it a hedge against inflation, but it also have a low correlation with other asset classes. In India, online trading and buying gold is a tradition and custom, and every Indian knows the value and importance of this metal. With so many benefits, and being an important part of one’s life, it becomes almost mandatory for us to invest in gold, but how to invest is a big question as now, it’s not important to hold gold in physical form. So, to help you choose, discussed below are the investment option that can be used for online trading in the yellow metal;

Gold ETFs are an open-ended mutual fund with each unit representing 1 gram of physical gold that is 99.5% pure. Similar to the shares, these units are traded on the exchanges.

Along with this, the gold ETFs carry some significant benefits that makes it one of the better option. Firstly, Gold ETF gives investor a huge opportunity to accumulate gold over a period of time. Separately, it does not carry any extra charges such as making charges, storage charges, which is incurred in physical gold, also there is no risk of theft, and can be can be sold at transparent prices across the country. Moreover, no sales tax, VAT or securities transaction tax is applicable on gold ETFs. Also, there is no wealth tax.

Join Us Now!

To Start Investment In GOLD

Also Read : SOVEREIGN GOLD BONDS – A GOLDEN DELIGHT !

E-gold is one of the newly introduced techniques of investment launched by the National Spot Exchange Limited (NSEL). Under this, investors can acquire the gold in smaller denominations and in the electronic form, which can be converted into physical gold also.

Gold Mutual Funds are basically fund of funds (FoFs), where brokerage firms or financial institutions invest the fund in their own gold ETFs or a foreign gold fund, which is the mother fund. Also, investors can make use of SIPs to invest in this mutual fund.

Gold mutual funds are exactly the same as other mutual fund scheme. Brokerage firms in India provide this service. However, buying gold through this option is still an expensive option as one has to pay the annual management charges for the underlying Gold ETF and annual management charges for the Gold FOF scheme.

Gold Jewellery is the oldest and the most preferred method of storing gold in India. Research shows that over 16,000 tonnes of gold is there among Indian households predominantly in the form of jewellery. The market value of this is around Rs. 27.2 lakh crore, which is approximately twice the foreign exchange reserves with the RBI.

Buying gold jewellery is one of the good options, but as an investment this option is little traditional and over costly. Investor has to bear the additional charges for making, and if the gold is sold in this form then the vendor will buy it below market rates, and also deduct the making charges from the total price.

Equity based Gold Funds are also a good option to invest in the gold as there are companies that are involved in the mining, extracting and marketing of the Gold. However, this option is limited as there are only a few public companies that are involved in one or the other processes related to gold.

Also, the stocks having gold as their component are not much influenced by the gold prices as investors invest upon the performance of the company. Since, these are equity-based funds, therefore, investment via this option is suitable for the investors with a high-risk appetite, which is quite a risky market.

Also Read : Gold: Is it still a serious investment?

Opinion

In short-term, due to extreme demand-supply of the gold, prices may be volatile, therefore, stock market investors should adopt SIPs over a longer time frames such as five years and beyond.

Despite the options one chooses, gold is always a better investment in any form. The asset is a perfect hedge for inflation. Also, gold is one of the most preferred assets in a portfolio as it provides stability of returns along with an opportunity to maximize wealth over a longer time frame. Investing in an asset in a paper form allows more transparency in pricing, purity, convenience, as well as, no storage risk.

[email-subscribers namefield=”NO” desc=”Subscribe now to get latest updates!” group=”Public”]

[…] Also Read: How To Invest in Gold? […]

[…] Also Read : How To Invest in Gold? […]

thanks for the detailed breakdown. i thought it was quite helpful.