Background

Greece was a late entrant in the euro, admitted on back of some statistical fudging and was the second poorest nation in the bloc, after Portugal. Being part of euro, it started enjoying the benefits of cheap money as creditors looked Eurozone as one bloc without distinguishing between high creditworthy Germany and almost junk Portugal and Greece. Banks had the view that Greece is as safe as Germany. This false picture being painted by Greece came into light after the huge money had already pumped in and Greek governments had, by that time, started spending spree, not to forget the Athens Olympics in 2004! The Greek minimum wage rose astonishingly by more than 50% in the decade after Greece joined the euro, whereas EU average remained stagnant during that period. So it was clear that someone is enjoying on someone else money.

Grexit a trader should read

Now this poor province is in crisis and the story dates back to year 2009 when the tables turned and Greece triggered the regional financial crisis in 2009, after a far higher budget deficit than previously calculated emerged. Today, the unemployment in the country is at whopping 25 percent, the political situation has turned harsh, incomes have plunged, a lot of austerity measures implemented and the protests and riots are very frequent.

But this too hasn’t happened overnight!

Get The Benefits Of Lowest Brokerage Trading Account

The Recent Story

After been through the four toughest years in terms of financial impairments and sacrifices, Greece is now considering an early end to its bailout. This has led to a new Eurozone storm and political uncertainty and may have long term socio-economic impacts. Now, after a month long events of political turmoil, the end result was what happened on 25th January 2015, i.e elections where Syriza won hands down. This is a leftist party opposing the bailout, perturbing investors and creditors alike.

Investors and lenders fear Syriza will turn back the clock on many of the reforms introduced over the past few years, weakening its position in Europe and possibly pushing it out of the eurozone currency area.

Greeks are considering Germany as the culprit of this whole story as Euro’s strongest block is being too stringent for making the eurozone more frugal and competitive, putting persistently high pressure on weak links.

As proverb goes ‘Morning shows the day’, is the recently started year 2015 paving way for political mayhems going forward?

Implications

Now that the Syriza has come to power with a clear majority, this is expected to increase uncertainty in European economic picture. The conflicts are sure to happen over austerity measures and conditions, which have had the greatest ever impact on the economy of the country.

The clocks may turn back to anti austerity as the same was being promised by the Syriza and based his win on tax cuts and anti-austerity life.

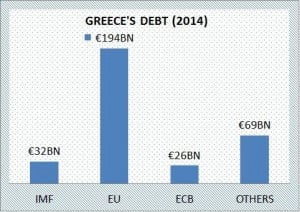

The current bailout plan for Greece envisions it will remain debt ridden for atleast a decade, with IMF predicting debt level subsiding to 117% of GDP in 2022, down from 175% today. Some Eurozone nations are of the view to offering more time to Greece to repay its debts.  Greece contributes only 2 percent to the Eurozone’s economy but the default by the country, after being dropped out of the Euro area, will open gates for the contagion to follow. This risk is being considered the biggest and deadliest of all. However after the recent stimulus by European Central Bank (ECB), the risk of contagion to other countries stand small as compared to what it was in 2012.

Greece contributes only 2 percent to the Eurozone’s economy but the default by the country, after being dropped out of the Euro area, will open gates for the contagion to follow. This risk is being considered the biggest and deadliest of all. However after the recent stimulus by European Central Bank (ECB), the risk of contagion to other countries stand small as compared to what it was in 2012.

Thankfully, the new government will take some time to renegotiate the bailout plan and is expected to only ease out some measures that would make Greeks’ lives easier than today. However, if the talks fail, grumblings may follow and the country will have to find out a new currency for itself!

Moreover it will be interesting to see if there’s some deviation from what the market has already discounted and what exactly the picture emerges on canvas after the government starts acting.

[email-subscribers namefield=”NO” desc=”Subscribe now to get latest updates!” group=”Public”]