Divergence is a concept used in technical analysis, it is one of the tools used for online share trading. Divergence indicators are a common feature in many trading platforms and trading apps. Technical analysis is based on price and volume indicators. When an indicator (usually technical) starts to move opposite to the underlying stock or security price, one has encountered a divergence. It is best to understand the concept through an example.

Significance of divergence with respect to trading

RSI Divergence

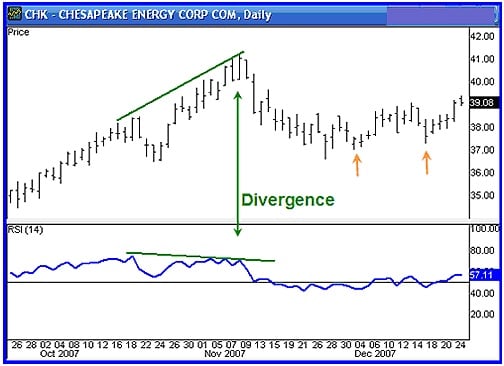

RSI is the relative strength index. Without going into the details, it measures the strength of an upward or a downward move. It has a range between 0 and 100. RSI above 70 indicates an overbought territory and RSI below 30 shows the market is weak. Let us say Nifty hit 9500 and RSI is at 75 levels. After a few weeks, Nifty hits 9800 but RSI remains at 70 indicating the move from 9500 to 9800 is not as strong as compared to the previous up move. In this case, one can say Nifty’s price action is divergent with the RSI indicator. As Nifty has still moved higher but RSI hasn’t. An illustrative chart is shown below.

Just as the above examples, there can be other indicators which shows a different picture of the coming future as compared to the current price of the security. Divergence is a good way to predict future price movements and provides an insight about the strength and validity of the current price movements. Online share trading platforms provided by various brokerage firms can show RSI very clearly.

Also Read: The Use of Oscillators

Positive and Negative Divergence

A positive divergence occurs when the price of a security makes a new low while the indicator starts to climb. Negative divergence happens when the price of a security makes a new high, but the indicator fails to do the same and instead closes lower than previous high. The above example given was a case of negative divergence.

How should divergence be interpreted?

The divergence is usually associated with oscillators. As with RSI, the oscillators measure the current state of price, volume or momentum relative to the historical range. The calculation of oscillators takes various factors into account. The oscillators are a great way to play a rangebound market.

When do divergences fail?

If the stock market is in a very strong trend, then these divergences can continue to provide a false indicator for a reasonable amount of time. As Newton famously once said “I can calculate the motion of heavenly bodies, but not the madness of people” – it is very true for financial markets. When the crowd sentiment is strong, these divergences may not work for a long time. Hence these should be looked at with caution.

Popular divergence indicators

Some of the popular divergence indicators are

- Relative Strength Index(RSI)

- Stochastics

- Rate of Change

Also Read: Comparison between Technical and Fundamental Analysis

[email-subscribers namefield=”NO” desc=”Subscribe now to get latest updates!” group=”Public”]