Anything that comes to us at a discounted price always lures us. We are always in a rush to throng the mall, ticket booking counter, online stores or departmental stores the moment we hear of a seasonal sale or price drop. But there are outliers to such patterns of behavior. Clouded with a thick air of skepticism, they are “Penny stocks”, the forbidden fruit of the stock market. These shares usually trade in the range of Rs 10 to Rs 20 with low market capitalization.

What makes it dicey is the temptation of high returns on one hand and extreme volatility on the other. In the past, Surabhi Chemicals, Jolly Plastic, Parikh Herbals and SRK Inds are all penny stocks that have even seen returns to the tune of 200% to over 1000%. Intriguing isn’t it? However, the age-old proverb, “All that glitters is not gold” finds its true meaning in such stocks. These are high-risk stocks which entice traders with huge profits, but also come with equal chances of a bigger loss. Needless to say, experts always advise risk-averse investors to avoid these stocks like plague.

The fears of the researchers or stock market experts are not unfounded. Let us see what exactly are the caveats that make these stocks such a risky bet?

- Problem lies at the root: Their very definition is perceived as a matter of concern. Penny stocks are usually quoted at such prices due to extremely negative perception in the market about the quality of their management and the excessive operational losses.

- Limited Information: For most penny stock companies, there is very little information available publicly. The research houses do not even cover them. Without adequate information, it becomes very difficult to make profound investment decisions.

- Highly Volatile: Penny stocks show extreme price fluctuation and fuel speculation. They tend to gain or lose value at a rapid speed. They create magic for retail investors, if they hit off, but they are too flimsy and can fall like a pack of cards. As much as they have a potential of increasing profit, there exists an equally large risk of losing all the money.

- Remains of a bastion: Many a times the once strong-performing mid-caps and small-caps after persistent erosion in value result into penny stocks. So these stocks are nothing but just leftovers and picking them is sure recipe for a disastrous portfolio.

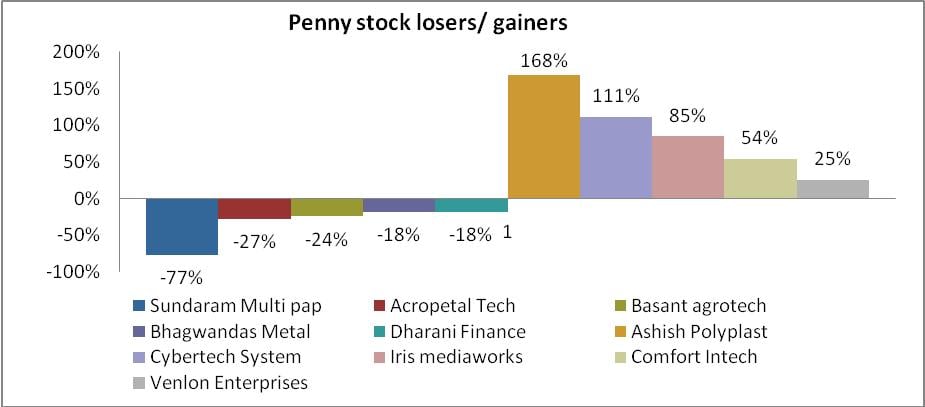

Source: bseindia.com, annual % change (Mar-13 to Mar-14)

But, just like life, things in stock markets are not always in black and white. It is said investing is not about value, it’s about price. Many with a contrarian view opine that penny stocks are not much a cause of concern as long as the investor is aware that the potential to deliver superlative returns comes with a generous garnish of risk element. Thus, a guarded approach works best for penny stocks.

- Invest only a small portion: Since these stocks come at a lowly price, many feel that buying a large number would be prudent, but it’s not true. Experts say only maximum 3% of the equity holdings can be parked in penny stocks if at all someone with a high risk appetite wants to venture.

- Profound research: Since ready research is not available for penny stocks, one needs to study the target companies in details before investing and check how much of upside potential do they have. Prospects of improvement in the company’s quality of management and operational efficiency need to be judged. Instead of following herd mentality and going by the mass mailers, a fundamental pick and choose virtue works best.

- Downside risk is limited, but exists: One should not view things with rose-tinted glasses and be complacent that there are no downside risks to the penny stocks. If there is a major corporate governance issue or event risk, the company will not be immune to it and you can lose money. Remember, penny stocks are sensitive and do not have the tenacity to withstand headwinds.

- Trading volume needs a check: Before touching a penny stock, its trading volume should always be checked. Most of these stocks do not enjoy much liquidity and are majorly owned by promoters. The past six months volume needs to be seen for consistency because sporadic patterns spell caution.

Investing in penny stocks takes courage and it cannot be denied that it is mostly the prerogative of aggressive investors with high risk appetite. Most of the adventurous investors have the itch to take that forbidden path. However, treading this path is really tricky and utmost caution is the name of the game when it comes to penny stocks.

Earn More From Penny Stocks

Open Trading Account With Us

[email-subscribers namefield=”NO” desc=”Subscribe now to get latest updates!” group=”Public”]

It is advisable to make trading and investment decisions in stock markets based on research, sound understanding of the markets and your risk appetite.

I also want to make some penny shares according to my interest but I have heard that penny stock is a risky investment.