If you have been exploring options trading, you might have experienced how options can lose value over time. This is where Option Greeks, or simply Greeks, can help you. They are valuable tools for assessing risks in the options market, where each risk is designated by a Greek symbol. This article focuses on Theta (θ). We will answer the following questions –

- What is the meaning of Option Greeks?

- What is the meaning of Theta in options?

- How to calculate Theta?

- How to interpret Theta?

- Why is it important to know Theta?

What Are Option Greeks?

Option Greeks are mathematical tools that help calculate how an option’s price will change in response to different factors such as its maturity date, interest rates, and volatility. These formulas are helpful in understanding how an option’s value may fluctuate and can help you make informed decisions about buying or selling options.

There are different types of Option Greeks with different functions. Here is a table highlighting this:

|

Option Greek |

Objectives |

| Delta (Δ) | Change according to the price of the underlying asset |

| Theta (θ) | Change according to the time of maturity |

| Gamma (γ) | Change according to the price of the underlying asset |

| Vega (ν) | Change according to volatility |

| Rho (ρ) | Change according to the interest rate |

What Is Theta in Options Trading?

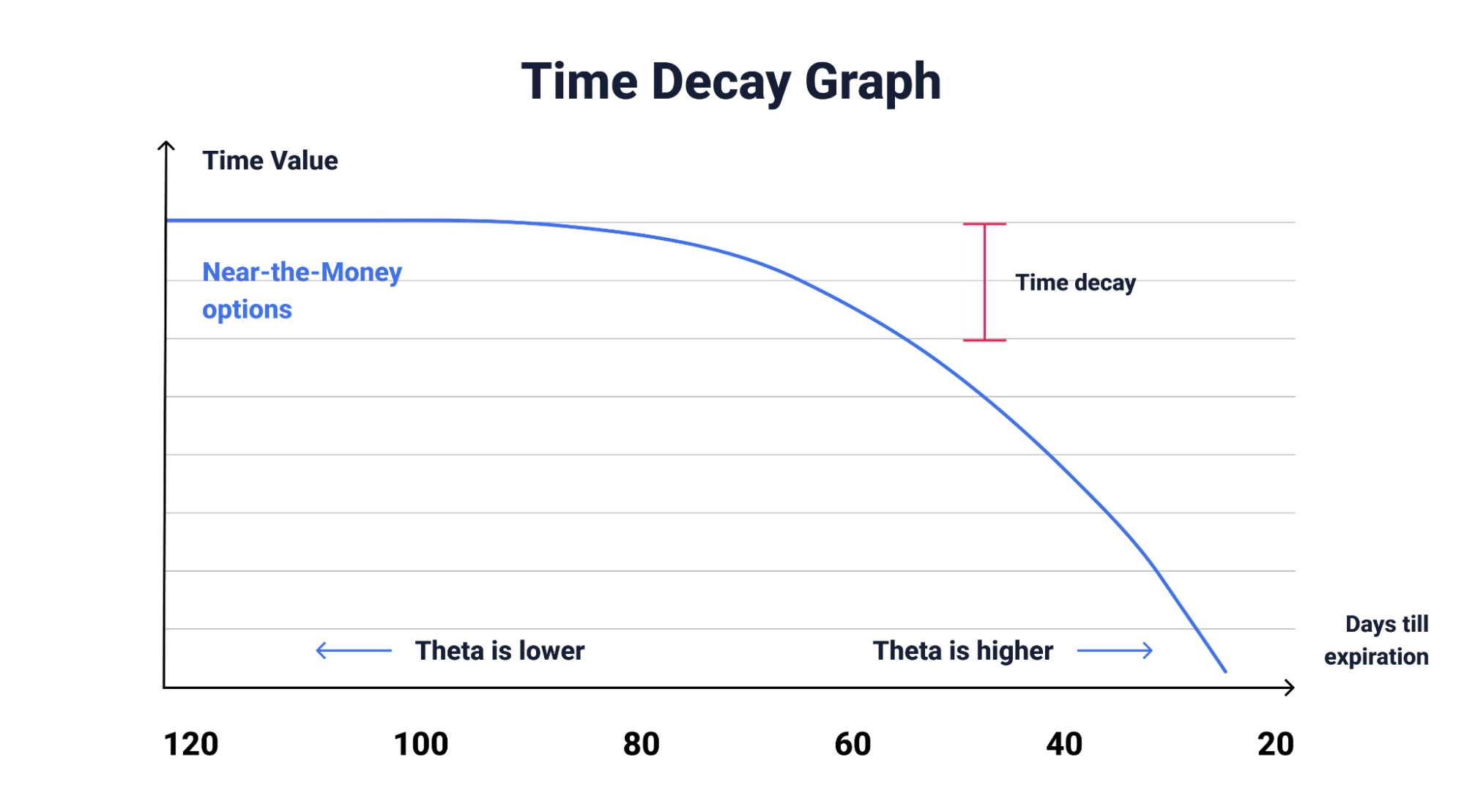

Theta is a Greek Option that measures the rate at which an option’s value decreases as its expiration date draws near. It’s a measure of time decay because it measures the fall of the price of an option over time.

Theta’s main assumption is that, over time, an option becomes less attractive to investors as it approaches maturity, assuming everything else is constant.

Example of Theta

If an option is worth $1.50 or ₹125.06 with a theta value of 0.05, the implication is that the option will lose 5 cents or ₹3.5705 per day as time passes, everything else being constant. Hence, if the spot price doesn’t move and the implied volatility remains constant, we would see a value of $1.45 or ₹120.90 the following day.

How to Calculate Theta?

When calculating Theta for options, remember that it is typically negative for long positions and positive for short positions.

The formula for calculating Theta is:

Theta = – (∂V/∂τ)

In this formula,

- ∂ = first derivative.

- V = options price based on the theoretical value.

- τ = option contract’s time to expiration or maturity.

While Theta can be a good measure, you must know that the values are not as reliable as you may expect. It is based on theoretical values and assumptions.

How to Interpret Theta?

When trading options, Theta represents the time decay risk, and it is usually negative for long positions. As your option approaches expiry, its time value decreases until it becomes worthless.

This dynamic makes it more profitable for sellers, who see an increase in value, while buyers experience a loss in value. This makes Theta an essential technical indicator for sellers, who refer to their actions as positive theta trades, while buyers’ actions are called negative theta trades.

By understanding Theta, you can make strategic decisions that align with your position’s risk profile and market outlook, which is crucial for navigating options trading.

Importance of Theta

Understanding Time Decay

Theta helps you comprehend how time decay affects your options positions. It quantifies the rate at which options lose value over time, aiding in informed decision-making.

Optimal Timing

By considering theta, you can pinpoint advantageous entry and exit points for your trades, maximizing profitability.

Risk Management

Theta assists in managing risks associated with options trading. Monitoring and adjusting positions based on theta allows you to mitigate losses and optimize rewards.

Enhancing Profitability

Utilizing theta enables you to refine trading strategies and seize opportunities to enhance profits.

Setting Realistic Goals

Theta helps you set achievable profit goals as options near expiration. Understanding its impact on options value empowers you to adjust strategies accordingly, aligning with your profit targets.

Conclusion

Understanding Theta is crucial when trading options. It’s a metric that helps you manage risks by measuring time decay. Using Theta, you can improve timing, increase profitability, and set realistic goals. Theta provides valuable insights into options pricing dynamics, empowering traders like you to make informed decisions. Incorporating Theta into your trading strategy helps you better understand the complexities of the options market.

However, it is important to understand that Theta is based on theoretical values and assumptions. The actual market conditions may vary. Therefore, it is important to consider other indicators and analysis techniques alongside Theta sound decision-making while trading.

Looking to start option trading? TradeSmart can help you with a comprehensive suite of educational materials and resources. Get access to the basics of option trading, strategies, market analysis, risk management, and more.

FAQs

Q1: How do you read Theta in options?

Theta is commonly expressed as a negative value for long positions and a positive for short positions. It represents the daily depreciation in the value of an option.

Q2: How do you manage Theta in options?

Calendar spreads can make use of Theta in options. This strategy involves capitalizing on the faster time decay of near-term options while potentially holding longer-term options to benefit from price movements.

Q3: What are Delta and Theta in options?

Delta and Theta are measures used to determine the price of an option. Delta measures the price change of an option resulting from a change in the underlying asset, while theta measures the price decay of an option as time passes.

Q4: How is Theta calculated?

Theta = – (∂V/∂τ)

In this formula,

- ∂ is the first derivative.

- V is the price of options based on the theoretical value.

- τ is the option contract’s time to expiration or maturity.

Q5: Is Theta good for options?

For options trading, a positive theta benefits sellers. As time passes, the option’s value decreases, favoring sellers. It’s advantageous for a neutral or bearish outlook with short calls and bullish with short puts. However, since it is a theoretical assumption, the actual market conditions can vary. It is crucial to focus on other indicators and technical analysis while making trading decisions.

[…] Also Read Theta of all Times […]