Welcome to the 19th edition of our Weekly Musings!

As the year came to an end, the benchmark Nifty 50 ended with a gain of 15% YoY, a stellar performance in a year when the nation was hit hard by the Covid-19 pandemic. In the 4th quarter of CY20, the benchmark index witnessed a solid rally on the backdrop of strong FII flows, the breakthrough achieved on the Covid-19 vaccine front, and better-than-expected corporate earnings.

Budget 2021 – Where do we go from here?

Things set to worsen over budgeted estimates, revised estimates, and actuals

The volatility in India’s GDP growth and buoyant projections of the finance ministry has, in recent years, led to a lot of debates on the budgeted estimates and revised estimates on revenue and expenditure.

The actual receipts and revised estimates have witnessed a wide variation since FY17. Particularly, in FY19, the gap between the actual receipts and the government’s revised estimates widened to 5.7%, with a similar trend playing out on the expenditure side.

Things are set to get worse in this year and especially during this budget, as the budgeted estimates, revised estimates, and the actual receipts will have to be completely overhauled, as:

- FY20 actual receipts are highly likely to be lower than the revised estimates on the back of a dismal Q4

- The budgeted receipts will be much higher than the revised revenue estimates for FY21 because of the pandemic

- While India has successfully controlled the spread of the virus for more than 4 months now, uncertainty can’t be ruled out in FY22, thus making it difficult for the government to come up with close to accurate estimates

The Wishlist

- At a time when India’s tax collections dropped for the first time in almost 20 years due to an unprecedented situation caused by the pandemic, the unemployment rate has risen, salaries have been cut, and this surely calls for providing additional liquidity in the hands of the salaried middle class which has not been a key beneficiary of any of the stimulus packages announced by the government.

- Instead of revising or doing an overhaul of the tax system yet again, the finance ministry could reduce the red tape by just increasing the minimum taxable income from the current Rs. 5 lakhs to Rs. 7.5 lakhs

- With states facing a stressed fiscal, they’re unlikely to provide stamp duty cuts for a long period of time. In order to boost the real estate sector, the Centre can chip-in and reduce the LTCG tax from the current 20% to 10%

- With fixed income instruments likely to fetch a low-interest rate in CY21 as well, the government should consider reducing the holding period of debt funds and ETFs from the current 36 months to 12 months for it to qualify as a long-term gain

Key Focus Areas

- Healthcare: The Covid-19 pandemic disrupted the healthcare system across the globe with some nations, like the UK, still suffering from the 2nd strain of the virus, and more so in India due to a population close to 1.3 billion. While successive central governments have promised to redefine the healthcare space in India, the major onus lies in the hands of India’s states as the subject falls under the State List as defined by the Constitution of India.

However, this time, the public health and sanitation measure witnessed close coordination between central, state, and local governments as the nation were gripped by the fear of a deadly virus.

Budget 2021 should make way for a provision for the digital health ID announced by Prime Minister Modi during his Independence Day Speech in 2020. Further, after collecting the data on the voluntary permissions given by citizen, the government must strive to create universal health coverage for at least 80% of India’s citizens

- Agriculture: India’s agricultural output has improved multifold due to sufficient rains in the last couple of years, coupled with additional cash transfers and from governments. In fact, agriculture has been the best performing sector of 2020, registering positive growth in all 4 quarters of CY20.

While the output has jumped significantly, the states and the centre have been incurring huge costs for the same. Various subsidies on utilities, ranging from power bills to purchasing tractors, have led to the states and centre bear additional costs. Moreover, many states have made it a tradition to waive off the loans, thus breaking the credit discipline of India’s marginalized farmers. In addition to various subsidies and loan waivers, India’s taxpayer bears a huge cost on MSP of many crops which after procurement, stays and rots in the warehouse of Food Corporation of India.

Rather than providing various subsidies and waivers and increasing the red tape, the state and central government should only opt for fixed cash transfers while cutting on other costs.

- Infrastructure: States contribute 40 percent of all the investments in India’s infrastructure. However, with the limited capacity left with the states for additional spending due to high fiscal deficit and lower levels of liquidity, the planned infrastructure activities could face a major roadblock.

Of the Rs 111 lakh crore, National Infrastructure Pipeline projects worth Rs 44 lakh crore are being implemented and Rs 22 lakh crore are under development. For proper execution of the projects in various development stages, appropriate funding and handholding is required to avoid any cost overruns.

States comprise 40% of the National Infrastructure Pipeline framework and are likely to miss out on many deadlines due to a dearth of funds. At this juncture, the centre must step in and raise money on behalf of the states by making some prudent arrangements. Further, as India gears up to host the G-20 summit in 2022, it should ensure smooth execution of the ongoing projects and facilitate industrial growth.

While an increase in government spending will be a big positive for markets, it’s time to remain cautious as any additional cess in order to compensate for the spending and keep the fiscal deficit in check will not go well with the benchmark indices which are at their all-time highs.

Democrats gain the control of the Senate; The implication on big tech, large businesses, and stimulus

After clinching a unified control of DC by winning the two Senate seats in Georgia, US President-Elect Joe Biden could find an easy passage to accomplish all the promises made during the campaigns.

While a divided house is always a preferred scenario to keep the checks and balances and to promote healthy debate, the Biden administration couldn’t ask for anything more than complete control.

As promised, he will highly likely reverse the tax reductions made by President Donald Trump in late 2017. Following are the possible outcomes:

- A stimulus cheque of $2000

- The Biden administration would place a bill to hike the corporate taxes from the current 21% to 28%; introduce a minimum alternative tax of 15%

- The federal income tax rate for the super-rich category could rise from the current 37% to 39.4%

- Additional payroll taxes on individuals earning more than $400,000

- Child and Dependent Tax Credit could rise from $3,000 to $8,000 (for one dependent)

- Tax relief for those who opt for student debt forgiveness and restoring the credit for first-time homebuyers

Providing tax relief for those forgiving student debts and restoring first time home buyers credit are steps in the right direction, however, the hike in taxes could well take a toll on the corporate earnings of the large business houses.

1st GDP Advance Estimate – Coming out of woods, But not the time to be complacent

The rapid spread of coronavirus cases and the measures to contain them hurt businesses and households, setting up the stage for the contraction in output for the first time in almost forty years.

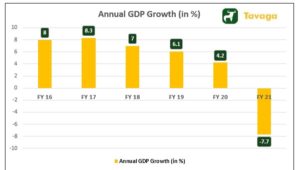

According to the first advance estimate released by the National Statistical Office (NSO), the Real GDP is estimated to contract by 7.7 percent in the ongoing financial year 2020-21 compared to a 4.2 percent growth in 2019-20.

Source: GOI, Tavaga Research; FY21 – Advance Estimates

The Real last contracted in 1979-80 by 5.24 percent. However, this is the steepest contraction since independence. This contraction estimate is steeper than a 7.5 percent decline forecast by the Reserve Bank of India.

The NSO release said that the GDP at constant prices (2011-12) or the real GDP for FY21 is likely to attain a level of Rs 134.40 lakh crore compared to the Provisional Estimate of GDP of Rs 145.66 lakh crore for FY20.

In nominal terms, the GDP is estimated to contract by 4.2 percent in FY21 compared to a growth of 7.2 percent in FY21. According to the data released so far, the contraction in GDP stood at 23.9 percent in Q1FY21 and 7.5 percent in Q2FY21, averaging a contraction of 15.7 percent in H1FY21.

Coming Up In The Week:

- IIP for November – 12th January

- Retail Inflation for December – 12th January

- India’s Balance of Trade – 15th January

- India to launch Vaccine – 16th January

Happy Investing!

Download the Tavaga Mobile Application And Link Your Trade Smart Trading Account:

Hello Gopal,

Glad to know you liked our blog. Please let us know in case of any queries.

Nice updates..keep up the good work