Welcome to the first edition of our weekly musings.

The backdrop of our maiden musings couldn’t have been more noteworthy – the consumer sentiment globally has again started to wane because of a confluence of factors, which include an imminent second wave of Covid-19 amidst the wait for the vaccine, geo-political tensions between India and China around the borders and the run- up to the US Presidential elections in November.

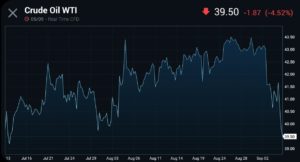

Source: investing.com, Tavaga Reserach

While the central banks have injected $20 trillion worth of liquidity through monetary and fiscal measures, it is exceedingly difficult for them to continue with the momentum as the fears of stagnation arise. Oil has slipped again below the critical $40 mark (source: Investopedia).

Auto Sales Back in Focus; Good Monsoons a Positive

Back home, as India goes into the 4th unlock phase after a prolonged and stringent lockdown, the auto manufacturers have registered significant growth in the sales in August.

The PV segment has performed extremely well in August and has registered a double-digit growth month-on-month.

With agriculture being the best performing sector of the last 6 months and the only sector to achieve a positive output in the Q1 of FY21, tractor manufacturers recorded a handsome growth of almost 70% on a YoY basis.

As the growth in sales of commercial vehicles is positively correlated to economic recovery, it might take some time for the segment to reach pre-COVID levels. However, the passenger vehicles and the two-wheeler category would continue to grow as most people to avoid public transport will prefer their own vehicle.

With a better than expected monsoon in 2020, agricultural reforms by states, and a good Kharif sowing season, the stellar growth in the sale of tractors is expected to continue in the coming months.

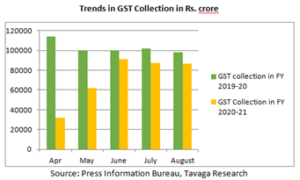

GST Compensation – Tiff between States & Centre

A key monitorable is the fall in GST revenue and the subsequent collection of cess by States and the Centre.

As per the Goods and Service Tax law, if the states’ GST revenue does not grow by at least 14% over the base year 2014-15 on account of implementation of the GST, the central government is liable to pay the states, the difference, after every 2 months, for the first 5 years of GST implementation.

This compensation is to be paid from the compensation fund which is created from the cess levied on items in the 28% slab of the GST law.

Due to the pandemic, the collection of indirect tax has been below par and the states have argued before the central government to compensate them for the loss in revenue. However, the Finance Ministry has communicated that the loss would only be compensated from the compensation fund if the shortfall arises due to the implementation of the GST.

States have been given two options to choose from:

- The Centre has further assumed a loss of Rs 97,000 crore on account of implementation of the GST and asked the states to borrow the money from the RBI for which the Centre would compensate entirely from the compensation fund, leaving no burden on the

- Alternatively, the States can borrow Rs 2,35,000 crore (entire loss due to GST implementation and Covid-19) for which the Centre would compensate the principal amount, leaving the burden of interest on states.

The cooperative federalism shown by states and centre for the last 3 years hit a roadblock when the states felt betrayed by these 2 options given by the finance minister. States argued by stating that the revenue shortfall be either fully compensated by the Centre from the compensation fund or by borrowing from the RBI to compensate.

What lies ahead in GST saga?

With 10 states set to reject both the options laid out by the Centre, the GST council can take the issue to a vote for the first time in history since the implementation of the GST law, with states accounting for 2/3rd of the voted and the Centre 1/3rd.

GST implementation has taken a lot of time and amicable resolution is an imperative to make GST a success.

Oil Prices at a 2-month low, hover ~$40 per barrel

Threatening the consumption of oil because of the increasing spread of coronavirus, oil started on a weak note in September 2020. The fall in oil prices can also be on account of a strong dollar and a falling demand for gasoline in the United States of America.

It is a common phenomenon wherein the crude oil market rallies if the equity indices rally. However, with the global sell-off starting from the US tech stocks to spilling out to other EM economies, the oil market also tumbled in the first week of September.

Oil prices to remain sluggish

A sluggish economic recovery and the weak labor market in the US does not augur well with the energy markets globally. With a small boost to oil prices as a result of OPEC+ cutting output by 7.7 million barrels per day, crude oil may not witness a sell-off similar to that of March but may remain range bound as a result of money managers liquidating their huge positions.

Coming up in the Week

- China Trade Balance figure for August – With an unexpected fall in imports and a rise in exports, China’s trade surplus rose to $62.33 billion in July 2020 as against $44.02 billion in July 2019. The balance of trade for August will be announced on September 7th

- Final Q2 GDP growth rate of Japan – The final figure of the GDP growth rate for the quarter ending June 2020 is expected in the coming week. Japan earlier reported a negative growth of 7.8% for the Q2 of FY21

- India’s Industrial Production for July – As the IIP contracted 6% in June, all eyes are set on the IIP figure for July to be announced on September 11th.

Happy Investing!

Tavaga Advisory Services is the official partner for providing advisory services to TradeSmart clients

Tavaga & Trade Smart has issued this report for information purposes only. This is not an investment document.

Please refer to https://tavaga.com/terms.html for disclosures.