Derivative Stats Date: 10 Mar, 2014

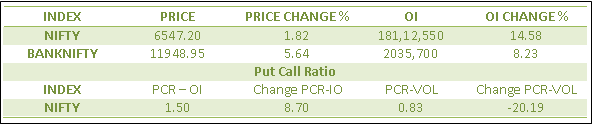

SNAPSHOT FOR NIFTY & BANKNIFTY AT DERIVATIVE SIDE

Observations:

- IO in NIFTY Futures increased by 14.58% while Bank Nifty Futures increased by 8.23%. NIFTY Futures closed at 6547.20 gaining 117PTS while Bank Nifty Futures closed at 11949 gaining nearly 650pts. NIFTY closed at all time high on Friday’s trading session.

- Nifty March Future closed with a premium of 21pts. While the April series closed at a premium of 58.35 points.

- NIFTY PCR – OI increased 8.70% to 1.50 levels.

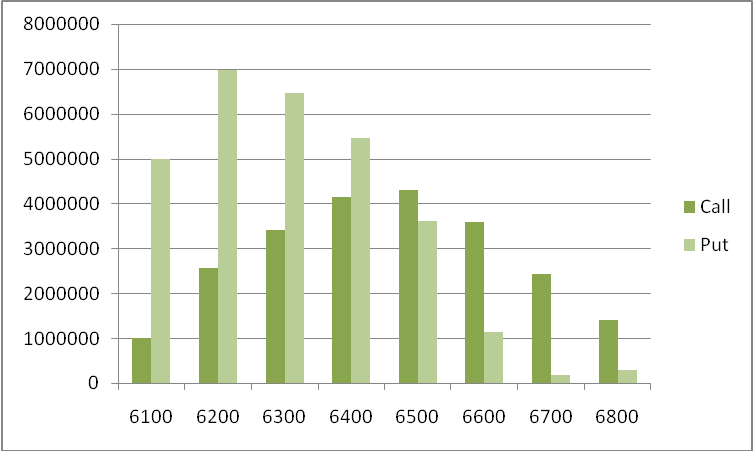

- In the NIFTY Option segment, 6500CE shown maximum OI followed by 6400CE. While 6200PE shown maximum OI followed by 6300PE.

NIFTY OI Distribution

In Cash segment, FII’s bought of Rs 6398.33cr while sold worth Rs 3820.89cr. So, FII’s were net buyer of Rs 2577.44cr.

On other hand, DII’s were net seller of Rs 669.58cr

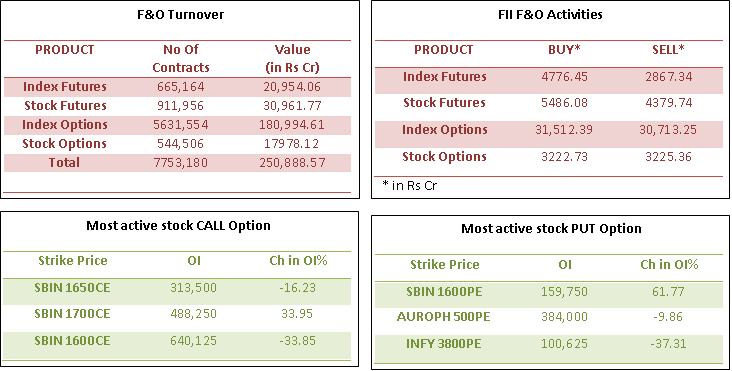

On Derivative side, FII’s were Net Buyer in Index Futures, Index Options and Stock Futures. While they were Net Seller in Stock options.

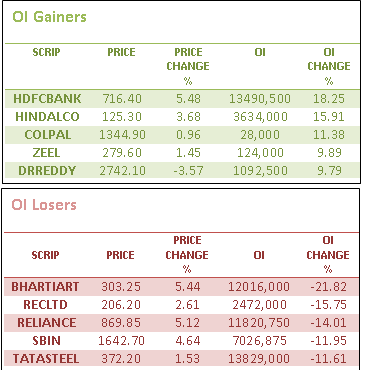

On Stock Future side, highest OI gainers were HDFCBANK, HINDALCO, COLPAL, ZEEL, DRREDDY while on highest OI losers were BHARTIARTL, RECLTD, RELIANCE, SBIN & TATASTEEL.