Welcome to the 8th edition of our weekly musings!

The backdrop of our maiden musings couldn’t have been more noteworthy – The improvement in high-frequency indicators continues with no negative surprises as optimism abounds with a sustained reduction in new Covid-19 cases and the pace of economic recovery for India. Over the seven-day period ending October 21, electricity consumption was 12% higher when compared to a similar period in 2019. Although the employment figures in the IT, hardware, and chemical segments have brought some respite, the hospitality industry continues to remain under pressure.

India’s Forex Reserves at lifetime high; Can we do better?

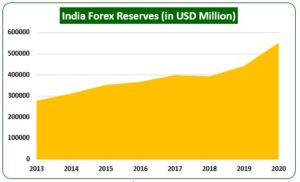

A stationary flow of foreign portfolio inflows and a rare current account surplus has led to India’s foreign exchange reserves surging to $555.1 billion, thus hitting a lifetime high. Compared with forex reserves of $275 billion since India’s external sector crisis of 2013, the foreign exchange reserves have more than doubled. The reserves have shown a significant jump since the beginning of this fiscal year.

The rise of India’s foreign exchange reserves

Source: DBIE-RBI, Tavaga Research

Forex reserves of $555.1 billion are enough to cover 12 months of imports and they make for nearly 99% of India’s external debt of $555.8 billion. By most metrics, these reserves are more than adequate as the purpose of self-insurance is fully served with so much accumulation.

Putting forex reserves to a better use

The significant growth in the reserves has sparked an often-heard debate about its utilization for economic upliftment at a time when the government is facing a spending challenge due to stiff finances.

Most of India’s forex reserves have been accumulated on the back of capital flows over the years while the current account has remained in deficit due to large-scale imports. In the Q1 of FY21, India reported a one-off current account surplus due to very low imports as the Covid-19 pandemic had brought the world to a standstill. This surplus is not sustainable and therefore, the utilization of forex reserves (built from capital account surplus) for building infrastructure and other allied activities may not be appropriate.

A sustainable boost to exports coupled with a persistent decline in imports can lead to a further rise in forex reserves due to current account surplus and these can be used for activities other than maintaining safety and liquidity.

Can these “abundant” forex reserves be channelized for better returns? While using the reserves for spending activities could be a bad idea and set the wrong precedent, RBI can surely ponder upon better return-generating products in these turbulent times.

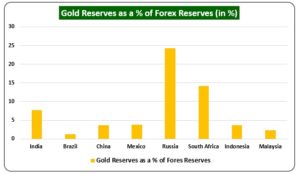

A major proportion of foreign exchange reserves are invested by RBI into high-liquid assets such as Euro-dominated bonds and the US treasuries, with a small portion invested into gold. The US and European Countries have their policy rates at near-zero and the sovereign yields of some advanced economics have gone into the negative trajectory as well. Therefore, it makes more sense to consider diversification of the investable assets. Increasing gold reserves as a percentage of forex reserves can be one such better return-generating tool for the central bank. India, in particular, has a good scope of increasing gold reserves as the RBI has followed a more conservative approach while investing forex reserves.

Gold reserves of emerging economies as a percentage of forex reserves

Source: World Gold Council, Tavaga Research

FPIs on a buying spree in October

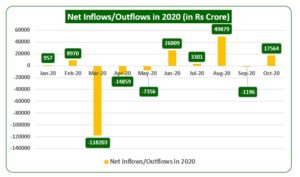

Owing to better-than-anticipated quarterly results, the foreign portfolio investors (FPIs) have pumped in net Rs 17,749 crores in October with a net investment of Rs 15,642 crore in equities and Rs 2,107 crore in the debt segment.

Net buying by FPIs has brought cheer to the market participants as emerging markets like Thailand, Taiwan, Brazil, and South Africa are witnessing net outflows month-on-month. Apart from the quarterly results, the surplus liquidity in developed markets and full resumption of business activities has kept the interest of FPIs intact.

Moreover, the accommodative stance maintained by global central banks could ensure foreign money flowing into the emerging markets.

Source: NSDL, Tavaga Research

The Covid-19 pandemic has caused a lasting effect on FPI flows in 2020. To add to the uncertainty, state elections in India coupled with the US Presidential elections will make markets more volatile, which could affect the FPIs participation.

New record cases forcing Governments over the globe to take a stricter stance

After scheduling several rallies in the worst-hit counties in the US, President Donald Trump blamed the surge in testing for the rise in the number of daily cases to a record high of 83,000. New York and New Jersey have contributed the most to the newly reported cases of the virus. Health emergency, extended for another month, is underway in New Jersey as the state reported the greatest number of cases since early May. While the fatality rate in the US is on the higher side, the chances of a pre-election stimulus have become increasingly low.

The European countries are expected to implement curfews more widely. France has reported record cases for three consecutive days; the positive rate jumped by a percent to 16 percent on Friday. Italian Government is also deliberating tightening the curfew norms, which led to anti-curfew violent protests by the public. The United Kingdom reported the fifth consecutive day with daily cases exceeding 20,000; schools may be suspended if the cases continue the trend. The Spanish Government is pondering over declaring a national state of emergency that would allow the authorities to impose stricter regulations over the public. While nearing the first-wave levels, Belgium’s reported cases have prompted the authorities to consider widening the curfew hours and closing the public places of utility such as theatres, fitness gyms, and museums.

Eurozone area has witnessed a contraction in their economic activity as indicated by the Purchasing Managers’ Index that fell below the 50-level mark in October. The services industry has been a drag on the headline PMI, which dropped from 48 to 46.2. With such low expectations for the services industry, the job market is expected to turn gloomy. Eurozone economy is at the risk of hosting a double-dip recession.

Coming up in the week:

- US September quarter GDP data – 29th October

- India Infrastructure output data – 30th October

- India fiscal deficit data – 30th October

- European region September quarter GDP data – 30th October

Happy Investing!