Welcome to the 9th edition of our weekly musings!

The year 2020 will go down in history as the year of volatility, divergence, and optimism. Since the economy was unlocked in June 2020, there has been a significant recovery in various macro and high-frequency data points. The sharp divergence across various sectors has been the defining characteristic of the performance of equity markets, globally.

The essentials, mainly healthcare and staples, the technology, and the E-commerce businesses were impacted far lesser compared to the financials, metals, infrastructure, and oil & gas businesses. On the contrary, the Covid-19 pandemic resulted in higher revenues and profits and a better outlook for the technology and healthcare sectors. This has become evident from the YTD performance of the healthcare and technology indices, as they’ve gained by 44% and 36% respectively.

On the other hand, the financials space, the most preferred destination of institutional investors and traders over the years has been adversely impacted due to the pandemic with the PSU banks and private banks declining by more than 20% YTD. This resulted in a total wipeout of Bank Nifty’s outperformance of four years over the Nifty 50 index in just the first half of FY21.

India’s fiscal deficit in the first half of FY21 rises to 115% of the target

The Covid-19 pandemic has resulted in severe revenue stress for the government as India’s fiscal deficit soared to 115% of the budgeted estimates in the first half of FY21. With a sharp revenue shortfall, the total expenditure of the government has remained close to similar levels witnessed last year as the central government continues its spending activity to defuse the impact of the pandemic by way of a stimulus package.

The difference between the government’s total revenue and expenditure stood at Rs 9.13 lakh crore between the start of FY21, i.e., between April and September. In the same period last financial year, the fiscal deficit was at 92.6% of the budget estimates.

| Revenue & Expenditure | April-Sep 2020 | 2020-21 Budget Estimates | % of Budget Estimates |

| Net Tax Revenue | 4.58 | 16.36 | 28 |

| Non-Tax Revenue | 0.92 | 3.85 | 24 |

| Non-Debt Capital Receipt | 0.14 | 2.25 | 6.5 |

| Total Revenue | 5.65 | 22.46 | 25.2 |

| Revenue Expenditure | 13.13 | 26.30 | 50 |

| Capital Expenditure | 1.65 | 4.12 | 40.3 |

| Total Expenditure | 14.70 | 30.42 | 48.6 |

| Fiscal Deficit (Revenue-Expenditure) | 9.13 | 7.96 | 115% |

Source: Business Standard, Tavaga Research

The budget estimates and targets are fixed in February (every year) and could undergo a sharp revision this year due to the unforeseen effects of the pandemic. With the government staying firm to its enhanced gross market borrowing of Rs 12 lakh crore for FY21, the fiscal deficit is expected to exceed 8% of the GDP against the initial expectations of 3.5%.

A spike in revenue collections in the second half of the financial year due to pent-up demand, festive sales, and pick-up in the broader economy will be a major factor while revising the deficit projections for FY21, sustenance is the key. With 5 months left for the financial year to close, the government’s ambitious and aggressive disinvestment targets will play a major role in helping the fiscal deficit to ease.

Organic growth in automobile and consumer durable sales helps in higher GST collection

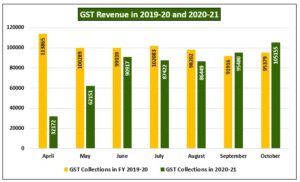

With GST revenues crossing Rs 1 lakh crore in October, the first time in this fiscal year, it joined the other broad indicators such as higher demand for loans and a rise in auto sales in signaling an economic recovery.

Apart from the higher sales of consumer durables and smartphones during the festive sales of E-Commerce companies, the surge in GST collection is mainly attributed to a spike in automobile sales in October.

Source: PIB, Tavaga Research

With the lifting of stringent lockdowns, the GST receipts showed a positive trend in September and October after showing a year-on-year contraction in the April to August period.

Amidst anticipation of strong sales during the festive season, the vehicle manufacturers ramped up the production of automobiles as auto sales continue to catch eyeballs with a hint of economic recovery in the second half of FY21.

Will this uptick sustain?

With most industry players witnessing a rise in their wholesale dispatches in October mainly on account of festivities, it will be very early to determine whether this will persist in the long term. Moreover, these being factory dispatches to dealers, the exact number of retail sales is difficult to gauge, but with festivals on and around, especially the upcoming Diwali in November, the retail sales are anticipated to be better than expected, else dealers wouldn’t have resorted to higher inventories.

While India’s urban economy continues to remain under pressure, the good purchasing power of India’s rural markets helped a robust rise in sales of automakers. The industry has seen a significant downturn for the last 1.5 years and this could well be demand-pull /pent-up appetite from purchases that were postponed.

If the positive trend in automobile sales fails to sustain after December, i.e., after the carmakers clear their inventories for the year, the government would prefer to intervene and tweak the much-demanded GST rate levied on automobiles.

Equity markets to remain choppy as US Presidential Election verdict comes closer

As US President Donald Trump closes in on Joe Biden’s lead in the opinion polls, the US election draws to a nail-biting finish this week. The Indian stock markets have been under immense pressure due to the volatility in the global markets on account of US elections, a rise in coronavirus cases in the US and Europe, and the collective chants for stringent lockdowns to curb the spread of the virus.

The Indian stock markets, however, might just lose their momentum in the short-term as the focus in the long term lies on earnings and the resurgence of coronavirus cases in India. In the longer term, India as an emerging economy might get positively affected under every outcome of the US Presidential elections, except one.

The 4 possible outcomes:

- A Joe Biden victory and Democrats securing both houses of Congress

- Donald Trump gets re-elected with Republicans keeping a hold on the Senate and the Democrats on the House of Representatives

- Biden winning the election with Democrats securing the House of Representatives and the Republicans keeping a hold on the Senate

- An election result that is stuck in courts

A Biden victory would improve the trade relations with India as India is expected to benefit from favorable trade policies of the US and this can eventually bring strength in the markets in the longer term as well, thus pushing up the sentiments.

With Federal Reserve’s low-interest-rate policy expected to continue in the months to come, a Trump or Biden victory will have no material impact on it at least in the near term. With a Trump victory, America could see an unorthodox chairman to head the Fed and the country might witness negative interest rates for the first time ever.

However, this could result well for India as the latter would be at the receiving end of cheap capital in the equity and debt markets.

The most uncertain and unwelcome possibility would be an election result that would get stuck in the Supreme Court, in that, there could be a likely sell-off in major emerging equity markets and could remain under pressure in the medium term with investors again resorting to the yellow metal.

Happy Investing!

Tavaga Advisory Services is the official partner for providing advisory services to TradeSmart clients

Tavaga & Trade Smart has issued this report for information purposes only. This is not an investment document.

Please refer to https://tavaga.com/terms.html for disclosures.