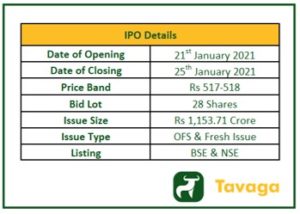

Home First Finance Company’s (HFFC) Rs 1,153.71 crore IPO opened for subscription on Thursday, 21st January 2021, i.e. today, with a price band of Rs 517-518 per share. HFFC IPO comprises an offer for sale (OFS) of Rs 888.72 crore by the promoters and existing shareholders as well as a fresh issue of Rs 265 crore. The prominent shareholders of the house financiers include True North Fund V LLP, Aether (Mauritius), and Bessemer India Capital Holding II.

Investors can bid for a minimum of 28 equity shares and its multiple thereafter. The subscription to the IPO closes on 25th January 2021. Up to 35 percent of the issue will be reserved for retail, 50 percent for the QIBs, and 15 percent for the non-institutional category.

The book running lead managers of the company include Axis Capital Ltd., ICICI Securities Ltd., Credit Suisse Securities (India) Pvt. Ltd., and Kotak Mahindra Capital.

Source: Tavaga Research

Utilization of Funds

HFFC plans to utilize the proceeds from the issue towards augmenting its capital base to meet future capital requirements, arising out of the growth.

Background

Mortgage financier Home First Finance Company (HFFC) Ltd. is a technology-driven affordable housing finance company (AHFC) that targets first-time homebuyers in the low and middle-income categories.

It offers individuals in those income groups housing loans for the purchase or construction of homes. HFFC further offers other loans such as loan against property (LAP), developer finance loans, and loans to purchase commercial property.

Established in August 2010, by former Mphasis Chairman Jaithirith Rao and Bank of Baroda’s MD and CEO PS Jayakumar, who are stalwarts in their respective fields. The target audience of the company could be the salaried class who work in small firms or self-employed individuals running small businesses.

The company provides an end-to-end digital onboarding process, the ease of which makes it popular among customers.

Home First Finance Company Shareholding Pattern

Source: Bloomberg Quint, Tavaga Research

Branch Network

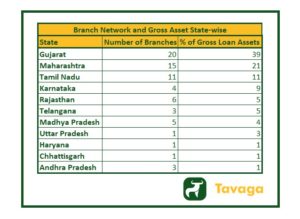

Due to its solid business model, HFFC has managed to establish a highly visible presence with a network of 70 branches spanning over 60 districts in 11 states and a union territory, as of 30 September 2020.

However, the company has a noteworthy presence in the urbanized regions of Gujarat, Maharashtra, Tamil Nadu, and Karnataka. According to a CRISIL report, the states and union territory in which they a presence accounted for about 79 percent of the affordable housing finance market in India during FY19.

Source: Bloomberg Quint, Tavaga Research

Use of Technology

HFFC has leveraged technology in various facets of its business such as processing loan applications, risk management, and managing customer experience. They have developed paperless processes for onboarding customers efficiently and their well-trained front-end teams appraise customers by visiting their homes and workplace to ensure minimal disruption to a customer’s daily routine.

Competition

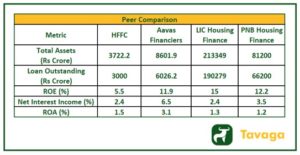

Its primary competitors are state-run banks, private lenders, public sector housing financiers, financial institutions, and other NBFCs.

Source: Tavaga Research

Financial Metrics

The company primarily offers customers housing loans for the construction and purchase of homes, which comprise around 92 percent of the company’s Gross Loan Assets, as of 30 September 2020. The other loan types include loan against property (LAP), developer finance loans, and loans for the purchase of commercial property amounting to 5.1 percent, 1.9 percent, and 0.9 percent of Gross Loan Assets, respectively, as of 30 September 2020.

As of the same date, around 33 percent of the company’s Gross Loan Assets were from customers who were new to credit. The average ticket size of the housing loan at the house financing company was Rs 10 lakh.

The company has recorded robust loan growth over the past 3 years wherein the loan book grew from Rs 1355.9 crore to Rs 3618.4 crore from 2018 to the end of September 2020. The net interest income for the same period rose from Rs 69.5 crore to Rs 228.4 crore. The NIM for the company stood at 5.1 percent at the end of FY20. HFFC net NPA was a meager 0.7 percent on 31st March 2020.

Risks to watch out for

The biggest threat for HFFC is the availability of cost-effective funding sources. Historically, the company has sought funding from commercial banks, the National Housing Bank, and through assignment transactions.

Also, there is tremendous volatility in borrowing in lending rates. For instance, Finance cost represented 64.4 percent of its total expenses in the six months till 30th September 2020.

HFFC Anchor Book

Of the 25 anchor investors in Home First Finance Company, Nomura was the biggest investor buying 9.5% of the anchor portion for Rs. 33 crores. This was followed by Fidelity International that picked up 7.2% for Rs. 25 crores, Morgan Stanley IM, Buena Vista, and TT International, which bought 5.8% of the anchor investor portion.

With Budget 2021 less than a fortnight from today, companies have lined up for fresh listings as they fear an imminent sell-off pre/post-budget. Investors must stay cautious and consult a SEBI Registered Investment Adviser before subscribing to the IPOs.

Disclaimer: The above write-up is only for educational and informational purposes. Kindly do not consider this as a recommendation to buy or sell the stock / subscribe to the IPO.

Happy Investing!

Download the Tavaga Mobile Application And Link Your Trade Smart Trading Account: