The eternal battle of investments, in one corner we have a nice safe and stable option of investing in real estate which almost always generates steady profits. In the opposite corner we have the Sensex which is a riskier investment but has potential to make quicker profits within a shorter period of time.

How stock trading has emerged as a winner

Time to place your bets…

Ring Ring – Round One – Capital Requirement

The Sensex as we all know requires very little capital to get in on the action, the common man would not need to think twice before taking a chance on the share market with a small portion of his daily or monthly savings. On the other hand purchasing real estate requires a considerable amount of capital, even if it is a plot in a Tier – 2 city. The average Indian would need to save up for a while before he could consider purchasing real estate in a metro.

Round 1 is won quite easily by the Sensex.

Start Investing in Share Market

Open Trading Account Now

Ring Ring – Round two – Risk return ratio

Real estate is a fairly safe investment, as long as the investor makes sure all the legalities are in order. A real estate investment in a Tier 1 or Tier 2 city has little to no chance or depreciating in the long run. With the Sensex however you are a constant risk of losing your capital but your potential to make profits is far higher than with a real estate investment. The question then becomes, is the risk of investing in the Sensex worth taking? The answer to this one is subjective, it depends on demography and risk appetite but we are going to go ahead and give this round to real estate. In the long run investors look for a more stable investment rather than having to constantly worry about their funds.

Round 2 is won by the Real estate.

Also Read : How long term Investing has changed in India

Ring Ring – Round three – Liquidity

Right off the bat real estate takes a hard hit from the Sensex in this round. It’s fairly obvious that when it comes to liquidity, the Sensex would get preference from any sensible investor. Investing in real estate means locking away a large amount of capital for a long time period, the investor would need to need to wait for his investment to appreciate and reach a target price that he would be willing to sell at. He would then need to find a buyer, which could take a while depending on phase that the real estate market is in. Stock trading in the Sensex can be liquidated at any point of time without too much hassle.

Round 3 is won by the Sensex.

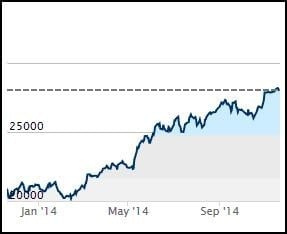

The past year has been extremely lucrative for both real estate and Sensex investors. Property rates in Mumbai for example, have risen consistently throughout the year and the Sensex has been touching all-time highs every other day. In such a strong bullish market it’s difficult to make a bad investment.

Also Read : Sentimental Economy

The below graph shows the trend of the Sensex in the year 2014.

Stock Trading & Real EstateIn this match the Sensex has emerged as a winner, it’s a pretty even competition though. Thus, the decision between real estate and Sensex can be made by asking yourself the following questions; Are you willing to invest a large amount of capital? Are you ready to commit to a long term investment? Do you have a low risk appetite? If the answer to all of these questions is yes then you should place your bets on real estate if not, Sensex is the way to go.

Stock Trading & Real EstateIn this match the Sensex has emerged as a winner, it’s a pretty even competition though. Thus, the decision between real estate and Sensex can be made by asking yourself the following questions; Are you willing to invest a large amount of capital? Are you ready to commit to a long term investment? Do you have a low risk appetite? If the answer to all of these questions is yes then you should place your bets on real estate if not, Sensex is the way to go.

[email-subscribers namefield=”NO” desc=”Subscribe now to get latest updates!” group=”Public”]

[…] Also Read: Sensex vs Real Estate – How should you place your bet? […]