As an investor the question often comes in mind whether festivals have an impact on the Indian Stock Market. As the second half of the Indian calendar year arrives, the list of festivals keep growing and one tend to think if more money should be invested to reap more profits. Let’s pick the S&P CNX NIFTY as a test criterion, as it has the most number of liquid scrip in the portfolio.

Impact of Ganesh Festival on Share Market

With Ganesh Chaturthi arriving, it’s important to do some measured analysis based on historical to evaluate the impact of this auspicious day. A series of daily returns from the historical closing prices have been generated. The calculation based on the two-return series is as follows –

Rt = [(P1 – P0) / P0] x 100

Rt = daily return at time t

P1= daily closing price at time t

P0 = daily closing price at time t-1

Out of the daily-return series, separate return series for some of the key festivals have been generated – Ganesh Chaturthi being one of them. Pre-festival and post-festival returns have been arranged for 10 years in lines to seven, fifteen and thirty days. Pre-festival data has been included only in those cases where the market is open on the festival day.

Also Read : Muhurat Trading- a mere ritual?

Hypothesis

H0: No recordable impact of festival on the mean-return of index pre and post-festival.

Data

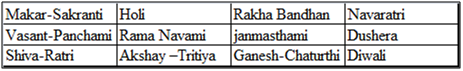

Non-probabilistic convenience sampling process is employed to gather the data for this analysis. The festivals selected are as follows –

Statistics

Descriptive stat is key to analyse the characteristics of this series. The measure of skewness indicates the level of non-symmetry. The measure of peakedness of data is called kurtosis. Calculating the mean and standard deviation are the two initial steps of this analysis.

Interpretation

The results infer that the daily average return for both NIFTY and SENSEX are near about 0.07% for the 10 years of data between 2003 and 2013. On the other hand, the standard deviation for both the index is around 1.65%, which mirrors the variability of the mean observation. Hence, over the period of ten years, the return fluctuates about 2% on a daily basis. But, the maximum return and minimum return for daily return is 12% and 16% respectively.

The kurtosis value is around 8 and 9 for both the index respectively for daily-return series and this describes its leptokurtic distribution with negative skewness.

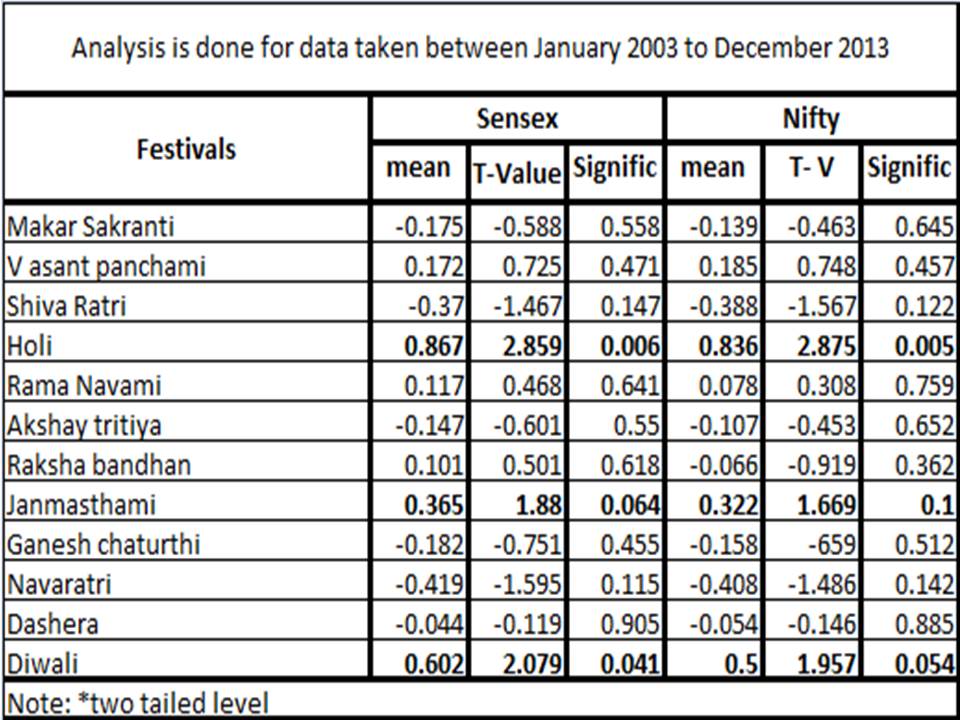

Paired Sample t-Test on the ten years data has also been carried out in order to measure the influence of festivals on return of NIFTY and SENSEX. The p-Value in the table for the various festivals shows the following inference –

1) Makar Sankranti, Vasant Panchami, Shiv Ratri, Ram Navami, Akshaya Trithiya, Raksha Bandhan, Ganesh Chaturthi, Navaratri and Dashera are greater than 0.1 which states that these festivals don’t influence the mean return of the market significantly.

2) However, Holi, Janmashthami and Deepawali are lesser than 0.1 which means that null hypothesis is rejected as these festivals have significant influence on the mean return of the index.

Looking at the above, it clear that retail investors shouldn’t think too much before investing with regards to Ganesh Chaturthi. Rather, it is important to focus on the Stock fundamental and technical. Ganapati Bappa Morya!

Start Your Trading Journey By Saying Ganpati Bappa Morya !!!

[email-subscribers namefield=”NO” desc=”Subscribe now to get latest updates!” group=”Public”]