Welcome to the 20th edition of our Weekly Musings!

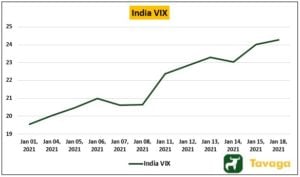

Amidst better-than-expected Q3 earnings and strong FII flows, the benchmark indices hit their all-time highs in the week that ended on January 15th, 2021, however, the rally came to a halt with rising bond yields and weak global cues. The spike observed in VIX truly indicates many more fluctuations and swings in the run-up to Union Budget 2021.

Source: investing.com, Tavaga Research

January 16th marked an important date in India’s history as the planet’s largest vaccination drive was launched in the country with an aim to vaccinate 3 crore people (frontline healthcare workers, senior citizens, and doctors) in the first phase.

While the vaccination program began on the weekend, the markets are less likely to react positively on this cue, as India still remains one of the best countries to keep the virus under control, unlike the European nations who continue to struggle with new mutants and large infections.

As the date gets closer, the markets are expected to focus more on the chatter around budget 2021 with the government likely to focus more on healthcare, manufacturing, and infrastructure. Apart from these segments, job creation, and disinvestments could well find a prominent place in the FM’s budget as India is expected to clock-in a record fiscal deficit for FY2020-21.

The month of January witnessed yet another stint of strong FPI flows with net buying of Rs. 17,000 crores after clocking-in a historic Rs 1.6 lakh crore in CY20. As India continues to perform better than its peers (relating to fighting Covid-19 and improvement in economic indicators), there’s enough steam left ahead for robust FII inflows. That said, the last few days of January 2021, could witness a sell-off by the FIIs, contributing to volatility with a budget around the corner.

US President-Elect Joe Biden will finally take the oath during the 59th Inaugural Ceremony to be held on 20th January 2021, and any new announcement by Biden around fighting the pandemic during the ceremony would be closely followed.

Traders must stay cautious as volatility makes a scathing comeback. Short-term traders must avoid naked leveraged positions, while the investors must grab this opportunity to accumulate quality businesses at lower prices and ETFs at lower NAVs.

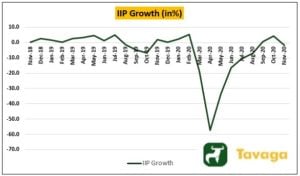

India IIP declines 1.9% in November 2020 v/s 4.2% growth in October 2020

Index of Industrial Production (IIP), a gauge of the industrial production that takes into account the activity recorded in sectors such as mining, electricity, and manufacturing showed that the IIP contracted 1.6 percent for the month of November 2020 as per the data released by the Ministry of Statistics and Program Implementation (MOSPI).

The industrial production in the country had grown at 4.2 percent for the month of October, while it plunged 0.48 percent in September. The previous high was recorded in the month of February 2020, when the output rose by 5.2 percent.

Source: MOSPI, Tavaga Research

In percentage terms, manufacturing and mining output contracted by 1.7 percent and 7.3 percent. On the other hand, the output for electricity expanded by 3.5 percent in November 2020. However, the IIP index, as per user-based classification, was recorded at 121.3 for primary goods, 136.7 for intermediate goods, 84.6 for capital goods, and 135.5 for infrastructure goods.

Meanwhile, the output of eight core sectors, as known as infrastructure output, for the month of November 2020 contracted by 2.6 percent, said the ministry release. The driving factor for this contraction was the decline in the production of crude oil, refineries, steel, natural gas, and cement. The core sector production had recorded a 0.7 percent growth in the same month last fiscal.

With this development, all eyes would be on the GDP data to be released by the government, as industrial production is an important barometer to gauge the GDP growth of a nation. A minor contraction in IIP for November 2020 does not change much of a thing for Q3FY21 and hence, the real growth (decline) figure for the 3rd quarter could lie within the range of -1% to +1%.

CPI Inflation at 12-Month low in December 2020

A key concern about the Indian economy for the last few months has been the inflation print, which has consistently been above the monetary policy target range of 2-6 percent. This volatility in inflation was primarily a result of the supply-side disruption caused by the lockdown.

However, the Consumer Price Index (CPI), a measure of the country’s retail inflation, eased to 4.59 percent in the month of December 2020. This retail inflation number came in at 6.93 percent for the month of November 2020 and 7.35 percent in December 2019. The decline in CPI was mainly due to a decline in food prices.

Source: MOSPI, Tavaga Research

The RBI considers retail inflation as the primary factor while determining its bi-monthly monetary policy. In the last bi-monthly monetary policy meeting, the central bank had left the key policy rates unchanged and decided to maintain an accommodative stance as long as necessary at least for the current financial year.

The Consumer Food Price Index (CFPI) or inflation in the food basket eased to 3.41 percent for the December month, down from 9.50 percent in November. This can be primarily attributed to a fall in vegetable prices that slipped -10.41 percent on-year in December.

The number for wholesale inflation for the same month came in at 1.22 percent, showed the data released by the commerce and industry ministry.

Coming up in the week:

- China GDP and Industrial Production – 18th January

- Joe Biden Inauguration – 20th January

- Japan, ECB Interest rate decision – 21st January

Happy Investing!

Download the Tavaga Mobile Application And Link Your Trade Smart Trading Account:

cheap jordan 12 for sale

$ 83.18Cheap jordans 11 Retro Low Bred