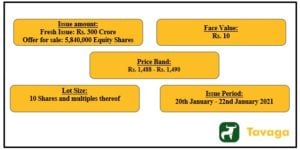

The Indigo Paints IPO will be open for subscription for the public on 20th January 2021 and will remain open till January 22. In a press conference held on 14th January, it was announced that the portion for anchor investors will open on 19th January. The price band for Indigo Paints is between Rs. 1,488 and Rs. 1,490. Details for the IPO are as follows:

Source: Tavaga Research

Utilization of funds

The amount raised would be utilized by the company for the below purposes:

- 150 crore – Capital expenditure to be funded to expand the existing facility in Pudukkottai, Tamil Nadu by means of an additional unit that would be adjacent to the existing one.

- 50 crore – Purchase of gyroshakers and tinting machines.

- 25 crore – Repayment / Prepayments of all or certain borrowings

- 75 crore – General corporate purposes

Background

Backed by Sequoia Capital, Indigo Paints was established in 2000 and initially started with lower-end Cement paints, then diversified into Primers, Distempers, Interior, and Exterior Emulsions. The decorative paints industry is as big as Rs. 403 billion and has grown at a CAGR of 11.5% from FY 2014 to FY 2019.

Indigo paints operates in an Oligopoly of four large players namely – Asian Paints, Berger Paints India Ltd., Kansai Nerolac Paints, Akzo Nobel India Ltd, and these competitors hold ⅔ of the market share.

Indigo Paints is the 5th largest player in the decorative paint manufacturing space and is also the fastest-growing player based on its revenues from operations.

Brand Image

Indigo Paints holds a competitive position in the decorative paints industry. It is the 1st paint manufacturer venturing into the production of differentiated products. They have greater than 28% of revenues coming from this portfolio of highly differentiated products. Indigo Paints also maintains the same name, ‘Indigo’ for its various lines of products, which makes it easier for the buyers to recognize the brand with ease.

Indigo Paints has a key strategy that they have stuck to since their inception – to start with Tier 3 and Tier 4 cities i.e. enter smaller towns first, establish a presence in the first four to five years with their differentiated products, and then head towards larger cities. They are now looking to increase their dealer networks in Tier 1, Tier 2 cities, and metros as well.

Coming to the advertisements and sales promotions, Indigo Paints have spent 12.7% in FY 2020 which is much higher than their industry peers whose expenditures stood at as low as 3.3%, however, the company expects this expense to gradually start tapering off as a percentage of their revenues.

Production capacity

The company has three manufacturing facilities in Rajasthan, Tamil Nadu, and Kerala. Their estimated production capacity for liquid paints stands at 101,903 KLPA (kilolitres per annum) and that for putties and powder paints, stands at 93,118 MTPA (metric tonnes per annum). The capacity utilization for liquid paints is 20.77% and for powder paints’ is at 57.98% as of September 2020.

Distribution

Indigo Paints is looking to increase its presence in the larger cities where there are untapped potential and huge opportunity to catch up with the bigger players. They are looking to increase the number of tinting machines by 1200-1300 every year, which would enable dealer output to go up by a factor of 2.5.

Indigo Paints currently has its presence in 27 states and 7 Union Territories in India, with each state being in a different stage of evolution. They have yet to enter Himachal Pradesh and have recently entered Maharashtra, Gujarat, Tamil Nadu, Karnataka, and Telangana. As of FY 2020, Indigo Paints has a distribution network of 11,230 dealers and 40 depots.

The increase in the active dealer network for Indigo Paints stood at 10.4%, standing third after Kansai Nerolac (17.3%) and Asian Paints (14.9%). The company finds approximately 85% of its revenues coming from smaller towns and the rest from the bigger cities.

With the help of the three strategic manufacturing facilities that Indigo Paints has at the moment, the company has low inward freight costs given its close proximity to raw materials. However, considering that long distances have to be covered for raw material and product delivery, their outward freight costs remain high compared to their peers. Furthermore, the company is dependent on third-party vendors for the transportation of both raw materials and finished products.

Key Metrics

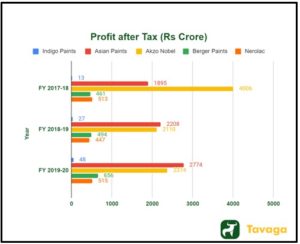

Source: Tavaga Research

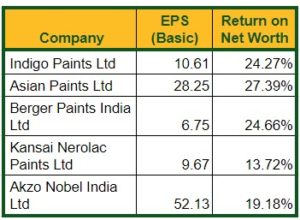

Source: Tavaga Research

Their PAT margins grew by 7.7% in FY 2020 from 3.2% in FY 2018. Indigo Paints stands 3rd in terms of EPS as well as Return on Net Worth as of March 2020.

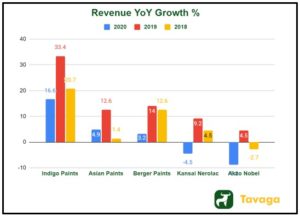

Source: Tavaga Research

When compared with its peers, as is seen in the chart above, it is visible that revenue for Indigo Paints on a YoY basis is growing at 16.6% vs Asian Paints at 4.9% and Berger Paints at 3.2%.

Source: Tavaga Research

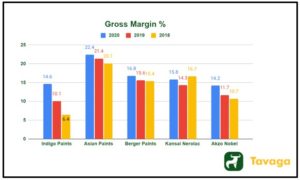

Similarly, the gross margin percentages for Indigo Paints over the three years as shown in the chart above, can be seen increasing at a steady pace, which at the end of March 2020 stands below Asian Paints, Berger Paints, Nerolac Paints, and above Akzo Nobel.

The EBITDA margin for Indigo Paints as of September 2020 stood at 18.5% while the revenue growth during the same period fell by only 4.9%. This fall in revenue growth is a relatively small number when compared to bigger players like Asian Paints (-19.5%), Berger Paints (-21.6%), Kansai Nerolac (-30.3%), and Akzo Nobel (36.1%).

Points to consider

- What investors need to watch out for, is the current slowdown in economic growth and its impact on business operations in the near future.

- Indigo Paints also has a few regulatory and statutory approvals and permits that are pending. Failure to obtain these would affect their business operations, financial position, and cash flows.

- There are also pending litigation proceedings by and against Indigo Paints, which might also have a significant impact on their reputation, operations, financial position, and cash flows.

- Similarly, any restrictions on imports of raw materials could affect their low inward freight costs.

Disclaimer: The above write-up is only for educational and informational purposes. Kindly do not consider this as a recommendation to buy or sell the stock / subscribe to the IPO.

Happy Investing!

Download the Tavaga Mobile Application And Link Your Trade Smart Trading Account: