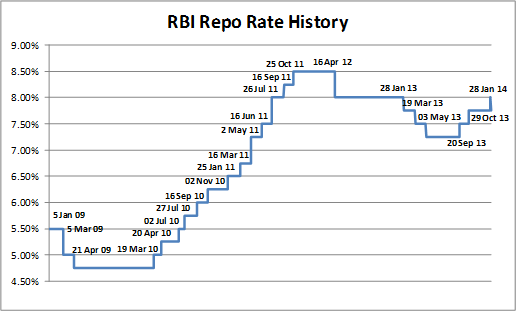

Yet another decision that didn’t cheer the markets or industry. With each passing meeting that ends in rates being held (on 18 December), the expectations for a cut in the next increase that much more, thereby leading to even greater disappointment when rates aren’t cut or in fact, raised! So why is the RBI so adamant?

After 4 rates cuts in the beginning of 2013, the RBI confounded the market by raising interest rates twice (Sept and Oct 2013) citing continued inflation concerns and held rates steady in December. Falling headline inflation numbers had raised expectations of a rate cut at the 28 January, 2014 meeting.

Source: RBI

Industry has been crying hoarse about the high interest rates increasing borrowing costs (analyst estimates put the average interest burden at 80%+ of operating profits for the BSE-500 companies) and consequently dampening demand and investment activity exacerbating the growth situation.

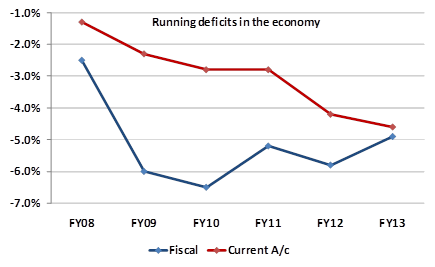

Interest rates should come down, but the question is when. The RBI has repeatedly said that depends (apart from inflation tending down) on how long the government takes to set its finances in order. Spending is currently financed by heavy borrowing that has credit rating agencies contemplating relegating India’s debt to junk bond status.

Source: Planning Commission of India

The question everyone is asking the RBI: “Is growth as much a concern as inflation?”. Pre-elections, the government would obviously like to further the growth agenda and has been trying to push the RBI’s hand to reduce interest rates. Despite the fact that the RBI is not independent (global surveys rank it as one of the least independent central banks in the world), it operates with some degree of autonomy on monetary policy. Under the new RBI Governor, a new conciliatory tone seems to have been struck between the Central Bank and the Finance Ministry.

The way forward

The RBI’s strategy of keeping interest rates high is designed towards dampening demand and hence inflation. So far, this seems to have worked well as evidenced by declining industrial production, slowing car sales, etc. Not surprisingly, the Government has lately been stressing the role of supply-side constraints in inflation stickiness (a new found urgency for project clearance seems to be part of this) – this is also designed to subtly imply that we have had enough of demand dampening measures by the RBI and holding rates high (or increasing them further) will have little or no impact on reducing inflation. This argument however ignores the potentially dangerous impact of reducing interest rates (consequently boosting demand/investment) in a supply constrained economy, further stifled by policy inaction.

Growth imperatives and government priorities:

To sustain India’s current growth, longer-term measures, such as cutting subsidies and building infrastructure, are needed. But that takes too long to win the votes of those whose most pressing concern is the price of onions.

Fiscal (government) and monetary (RBI) policies must work in tandem for growth to revive and for taming inflation. The onus for the tandem however rests primarily with the Government since the current fiscal disorder is holding the RBI’s hand in introducing growth-friendly monetary policies. The expected costly populism in the run up to general elections this year may yet disrupt the stated fiscal roadmap so eloquently espoused by the Government. A very interesting quote from a candid politician sums up the conundrum: “We all know what to do, but we don’t know how to get re-elected once we have done it” – Jean-Claude Juncker, Prime Minister of Luxembourg.

Well Written