Welcome to the 14th edition of our Weekly Musings!

The calendar Year 2020 has seen the worst as well as the best of India’s broader markets. The fall started with the news of coronavirus induced pandemic and the subsequent lockdowns imposed by the government. Nifty 50 and Sensex plunged by more than 35% in March and April 2020 as Nifty suffered the worst ever March since its inception in 1994. Circa December 2020, the flagship Nifty 50 and Sensex indices hit their all-time highs of 45,148 and 13,280 respectively. A mammoth gain of 75% in just seven months!

The GDP growth in the 2nd quarter of FY21 substantiates the performance of economic activities with a better than anticipated recovery in corporate earnings. High-frequency indicators such as electricity consumption, railway freight volume, new property registrations (on the back of low-interest rates, easy financing, and duty cuts), E-Way Bills, GST Collection, air traffic, etc. have formed a secular growth trend thus reflecting a continuity in the strong recovery of India’s macros.

While the agriculture sector continued with its robust growth on a year as well as a sequential basis, the manufacturing sector was undoubtedly the dark horse of all along with a satisfactory improvement in the services sector. In the manufacturing sector, new production failed to post positive growth, however, the surge in prices of many products helped companies to record a growth in gross sales in value terms. While the total income as anticipated declined on a yearly basis (10%), the decline in total expenditure was 14%, steeper than the contraction in revenue, driven by lesser input costs. While India’s manufacturing story has a brighter outlook, the flipside in the short-term cannot be ignored due to a large inventory build-up in some of the sub-sectors, thus leading to a decline in production volumes.

GST collection and auto sales continue to rise, boost recovery hope

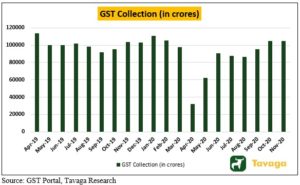

GST collections for the 2nd consecutive month remained elevated above the Rs 1 lakh crore threshold due to a pickup in consumption activities on the backdrop of festive demand and pent-up demand. The revenue for October (collected in November) remained flat as compared to the collections in October 2020 and was marginally higher than the October 2019 collection. The government managed to collect Rs. 1.05 lakh crores from the Goods and Service Tax, thus posting an annualized growth of 1.4%.

While many pundits claim the rise in GST collection (on a YoY basis) to be a feather in the cap for the government amidst a severe blow to the broader economy due to the pandemic, an in-depth examination of the trends in GST collection narrate an altogether different story. If the collections since inception are scrutinized well, the trend points to one inference: That the GST revenues are languishing and stagnating! The conclusion is on the basis of the highest GST collection of Rs 1.13 lakh crores in April 2019, since then the GST collections have dropped close to 8% signaling the taxman’s failure to break the previous records even after a strong pent-up demand coupled with festivities.

The lower growth collection is problematic for the central government on two counts:

- The budgetary apportionment from the Goods and Service Tax has been comparatively higher than actual collection, thus leading to a higher fiscal deficit

- The liability on the central government to pay the states the difference between budgeted and collected revenues, if the states’ GST revenue does not grow by at least 14% over the base year 2014-15 on account of implementation of the GST

After factoring-in both the points, the GST revenue collection should translate somewhere near to Rs 1.30 lakh crores every month. However, the Rs 1.05 lakh crore mark is almost 20 percent below the needed sum.

Can the taxman achieve what it desired?

The lesser leakages in the GST model can only be achieved by oversimplification and reforms. The objective of the GST framework was always to move towards auto-populated returns by way of e-invoices and simplified techniques to file GST returns. These two techniques could steadily help the government in the long term in collecting more revenues by preventing leakages.

However, the short-term outlook looks grim and a gigantic leap in higher revenues is only possible once the economy stabilizes and gets on track post CY2021.

Auto manufacturers, on other hand, continued to show some robust performances across categories on a year-on-year basis. The strong agricultural output, bumper festive demand during the Diwali season, availability of easy financing, and the preference for personal mobility due to the coronavirus induced pandemic resulted in decent sales for auto manufacturers.

While the dealers are sitting on a higher inventory of 2 wheelers, the momentum in higher sales of 4-wheeler autos is expected to continue at least for the next couple of months. As discussed above, with a slight pick-up in the manufacturing sector, the demand for commercial vehicles is expected to improve further as the construction activity strengthens further.

The next four months of this financial year will be crucial to gauge the performance of the sector as the effects of pent-up and festive demand are close to over. The sustainability in demand for automobiles in the first half of the next calendar year will be a key monitorable to watch out for.

RBI focuses on growth; avoids reclining towards inflation

During the policy review meet of the RBI MPC scheduled between 2nd-4th December 2020, the committee unanimously decided to keep the repo rate unchanged and forecasted the Indian economy to contract by 7.5 in 2020-21.

An unchanged policy rate by the RBI and the promise of continuing with the accommodative stance in its latest policy review meet leads to one and only one conclusion that the central bank is ready to step-up its ante on growth by keeping aside the inflation metric for a short period of time.

While the focus on growth wasn’t surprising, the commentary of the governor in terms of liquidity assurances amazed the street as the Sensex breached the 45,000 levels for the first time in history. The expectation was such that the various open market operations and other liquidity measures introduced by the RBI would cool-off with the improvement in various macroeconomic and microeconomic metrics. In anticipation of such an event, the money market and overnight market rates distorted the short-term yield curve and were way below the repo rate.

However, the governor signaled that it would continue with its OMOs, operation twists, and the bond purchases in the secondary market in order to flood the system with ample liquidity and help the central government in managing its Rs 12 trillion borrowing program.

As retail inflation in October 2020 rose the highest in six years (7.6%), the RBI rightfully admitted the concerns related to inflation and revised its estimates to 6.8 percent for Q3 of FY21, 5.8 percent for the first quarter of the calendar year 2021, and between the range of 4.6-5.2 for H1 of FY2022. The projections were slightly higher than what the street had estimated as RBI in October has forecasted the inflation to be in the range of 4.5-5.4 percent.

While there’s not much room left for the MPC to cut the policy rate in the short term, the members could well ponder upon it in the first quarter of FY22 if the economy doesn’t grow as per the forecasts. Tightening the monetary policy is out of the question right now as India is yet to fully recover from the shock caused by Covid-19.

Crude Oil Rallies As OPEC+ nations agree on supply; What future holds for Brent Crude Oil?

As major oil producers agreed on restraining the production of the commodity to subsist with the fall in demand due to the coronavirus pandemic, the oil prices rose for the fifth straight week and ended the week at $49/barrel (as of 5th December 2020).

OPEC+ nations (OPEC and Russia) reached an agreement on cutting the production of oil by 500,000 barrels per day, starting January 2021, and reviewing it once every month as the oil-producing nations failed to come to a compromise for the entire year.

While the production cut will help the Brent crude oil price to rise further, it could well remain volatile and within a specific range as nations differ on their opinions with respect to restraining the oil production every month.

As demand recovered in November 2020 with the hopes of a Covid-19 vaccine, the Brent crude oil price rose by 6.8 percent to end the month at $43.2 / barrel.

Happy Investing!

Download the Tavaga Mobile Application And Link Your Trade Smart Trading Account:

Trade Smart has tied up with Tavaga Advisory Services, a SEBI Registered Investment Adviser (RIA).

Through the Trade Smart-Tavaga partnership, both companies intend to democratize investment advisory and cater to investors’ goals and needs through more transparent and efficient investing.

Tavaga & Trade Smart has issued this report for information purposes only. This is not an investment document. Please refer to https://tavaga.com/terms.html for disclaimers.