What is Bottom up Investing?

When it comes to investing into stock market, the first thing that comes to our mind is how to identify the potential stock. Different professionals and investors have various styles of analyzing, however one style that has proved highly rewarding over time is “Bottom Up investing” approach.

Stock trader should know bottom up investing

Understanding “Bottom up Investing”

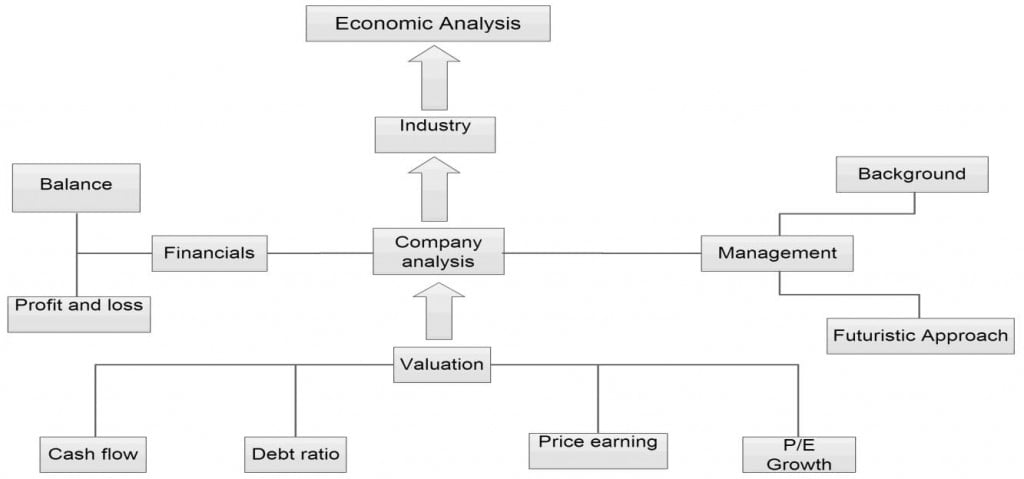

A bottom up approach focuses primarily on company specific opportunities rather than looking at the favorable economic environment. In other words, this approach focuses solely on the individual business where the investor bets upon the prospects of the company irrespective of the stock market or economic conditions, believing that a business with strong fundamentals is bound to outperform the peers over the long term.

Where to start with

To be able to make money out of the approach, one needs to have a strong understanding of the company’s business. One should perform SWOT ANALYSIS (strengths, weaknesses, opportunities and threats). A common practice done by the investors who look to invest through this approach is to prepare a minimum eligibility criteria and then filter out the companies that meet the criteria and then bargain hunting is done amongst the different players to pick the dark horse.

Let us take an Illustration

There is a company ABC Ltd that is into the business of pharmaceuticals which you expect to outperform in the long run. You work out that the company has strong R&D section, strong market share, cost advantage, product diversification and innovative management. Also you find the stock trading at a cheaper valuation than the market peers. You are confident about the existing product, new products that are in pipeline and the growth potential in the profitability of the company. This is how a bottom up investor looks at the potential investment, while puts the broader scenario like GDP, inflation, employment conditions & currency situations on the back foot. The idea however requires extensive details and research as the fundamentals are bound to change from industry to industry.

Challenges

One thing to mention at this point is that it takes a lot of understanding and foresights to pick stocks through this approach as fundamentals differ from industry to industry which makes the analysis an uphill task. Another big challenge remains the timing of the investment because ultimately whenever the economies are in bad shape, even good business can lose their edge as per the stock market conditions and can perform poorly for a period of time. Having said that, whenever the cycle picks up, strong businesses tend to do better again in the longer time frame.

Conclusion

The stock trading strategy may sound a bit difficult and tiresome for the beginners but like they say that every good thing comes with price tag. Similarly to make gain out of this way of investing, one need to pay the due amount of hard work and research. Many successful stock market investors like the legendary, Warren Buffet today have made huge profits by using this way of investing. One of his great saying goes like this “I only invest in businesses of the companies that I understand”. Everyone has a different way of analyzing and understanding things and there are hundreds of stocks that have significantly outperformed the indices year after year. So what you are waiting for, go for it find your sweet spot!!

[email-subscribers namefield=”NO” desc=”Subscribe now to get latest updates!” group=”Public”]