Options is derivative product in the sense that it derives its value from an underlying asset such as stock, bond, currency, commodity, interest rate etc. (For simplicity sake, we will assume stock as our underlying asset for all future references henceforth.) However, it is only the final payoff (at maturity) of this product that depends solely upon the value/price of the stock. During the term of the option, there are several other factors that affect the value of the option, the stock price being only one of them. Most important from the other factors is the Volatility.

Straddle option strategy in stock market

Implied Volatility:

Volatility is of two types: Historical and Implied. Historical volatility is the ongoing volatility of the stock over the concerned time period. Whereas implied volatility is what the market participants project / forecast the volatility to be, during the term of the option. So if the market players project that the future volatility in the stock will be the same as it is now, then historical volatility is the best estimate for implied volatility. This is seldom the case though.

But the key point is that options give the traders another variable to trade other than just the price of the stock. This other variable being “Volatility”. This means that if the trader is unsure of the stock price, he can still participate in the market by predicting volatility. Please note: You will ultimately have to predict something to make money in the markets. Arbitrage, however, can be considered one such strategy where speed can topple the forecast requirement. But then several arbitrages are based on the prediction of mean reversion as well.

Make The Most Out Of Volatility

Start Trading Now

Now since we have two variables to trade within the same underlying asset, this opens another range of trading strategies that can be exploited by the trader without having to predict the stock price. Such strategies are often needed, during times of elections, earnings announcement, budget and other major Geo-political and Economic events. This is because it is way harder to predict which way the stock price will head post the event but the volatility can be predicted to increase or decrease depending upon the importance of the event.

Also Read : Collar Strategy

Below is mentioned one such basic strategy that relies on predicting volatility and not so much the stock price. One key point to remember before using such strategies is that each option price has an implied volatility associated with it, which ultimately becomes the differentiating factor between a cheap and expensively priced option. Depending on the historical rates of implied volatility, we conclude whether the implied volatility quoted is high or low.

Straddle:

Buy/Sell a call and a put of the same strike and same expiration period.

Lets assume a situation where the stock price of ABC company on July 4th is trading near 2500 and there is an earnings announcement event coming in the next 7 days. Looking at history, we find that this event generally invites high volatility in the price of the stock. We then look at the price of the ATM call and put options.

The 2500 ABC Jul Call — Rs. 110 (Implied Volatility: 23%)

The 2500 ABC Jul Put — Rs.90 (Implied Volatility: 24.60%)

A simple buy straddle strategy would imply buying both the options together for a net premium outgo of Rs.200. This would mean that at maturity if the stock price is above 2700, you will make more than 200 on your call and zero on your put option (worthless; will not be exercised). On the downside, if the stock price goes below 2300, you will make more than Rs. 200 on your put option and zero on the call option (worthless; will not be exercised). This gives us our breakeven points at maturity of 2300 and 2700. Above 2700 and below 2700, your strategy will make money.

Now, a trader who has based his trade on the earnings announcement event will, in all likelihood, not be keeping his trade till maturity. Soon after the event, if the stock price becomes volatile and makes a major movement in either direction, he can simply book a profit there and then by closing his trade. However, if the stock price does not move, because of possibly one reason being that earnings came in as expected, then the stock price might now make volatile moves and it would again make sense for the trader to close the position since the underlying hypothesis of his trade (High volatility post announcement) was proved wrong. He will book a small loss since both put and call will still have some value.

There is another case wherein at the time of inception, the trader feels that the earnings announcement will come as expected and the market perception of volatility i.e. 23% call and 24.60% put is too high, he will then short (sell) the straddle of an incoming premium of Rs.200. If things go as expected, the volatility will come down bringing the prices of the call and put down leading to a profit for the straddle seller. However, if the volatility increases due to a shock in the announcement, he can stand to lose a great amount since volatility will increase and his hypothesis (Volatility will come down) has been proved wrong.

Apply This Strategy On Your Trade

Open Trading Account Now

Also Read : Options Strategy: Straddle and Strangle

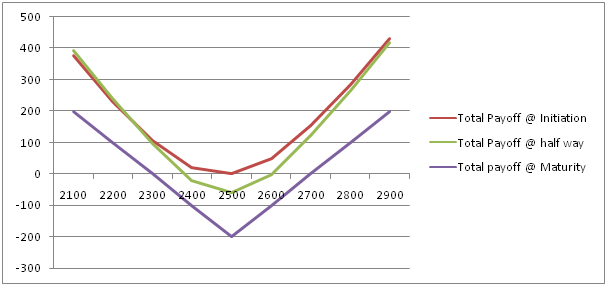

This is also a good time to understand the breakeven points. The breakeven points at maturity have been discussed to be at 2700 and 2300 before. However during the term of the option, the breakeven points will vary (Refer Figure below)

- Just After inception, the breakeven points will be close to the ATM price of 2500

- As time passes and volatility remains constant, the breakeven points will push further towards 2300 and 2700, finally reaching there at maturity

- If the volatility decreases, the breakeven points will move faster towards 2300 and 2700, as the stock price will then have to compensate for the decreased volatility by making more movement towards one side for any one option to get so much in the money so as to cover the combined premium outgo. This will be profitable for the seller as faster the breakeven points approach the ones at maturity, the more chance and longer he can stay with the profit in his hand.

[email-subscribers namefield=”NO” desc=”Subscribe now to get latest updates!” group=”Public”]

[…] Also Read : Straddle as a Volatility based Option strategy […]