An option’s value is impacted by changes in the price of its underlying asset. E.g. the value of a call and put option for gold vary with the movement of gold price. The amount by which, an option vary for the change in the price of the underlying is called as Option Delta. A delta value of 1 (that is also 100%) means that the option value varies one for one as and when the underlying price moves. If the gold value moves up a dollar, the call option with delta value 1 also increases by the value of a dollar.

Understand Gamma and its impact on online trading to the traders

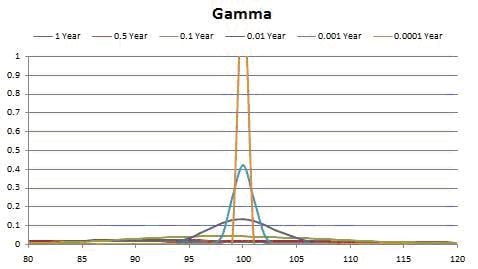

However, with options things are barely constant. An option’s delta is itself affected by the price movement of the spot price. The change in an option’s delta value for a change in the spot is called as Gamma. In simpler terms, Gamma is usually normalized so that it provides the change in delta for a 1 point change in the underlying price. E.g. a call option has a delta of .5, which is an at the money call option. If the underlying price moves up by a dollar, the call option’s delta value would increase by fifty-seven percent. This specifies that the call option Gamma value is 7.

Also Read : Theta of all Times

Gamma is quite useful as it talks about – how much a portfolio’s delta would change with the fluctuation of the underlying price. E.g. let’s assume that we are pursuing a strategy that is delta-neutral, which means that we are trying to sustain a delta of zero value. The gamma would point out as to how we would need to hedge the portfolio in case of the underlying price movement just to maintain the delta neutral scenario. This is quite a useful component.

Hedging a portfolio delta again followed by a move in the spot price can have a positive and negative impact on the P&L. Gamma is additive in nature across all kinds of options of any duration. In order to find out the gamma exposure in totality with respect to a single product, one would just need to sum up the gamma values of all the options for that product irrespective of their expiry date.

Gamma is the most significant second order green option. All options have a positive gamma irrespective of whether it is a call or a put. Hence, to buy gamma, one needs to buy options. Gamma differs depending on the option’s strike price relative to the underlying price.

Join Us To Earn More

Start Trading Now!

[email-subscribers namefield=”NO” desc=”Subscribe now to get latest updates!” group=”Public”]